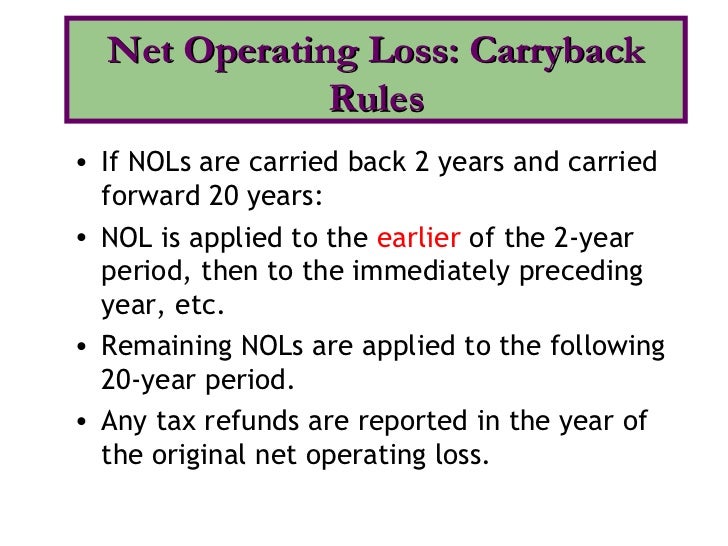

In our earlier example, the $20,000 NOL might be used to scale back your taxable income in future years, leading to tax savings. The advantage of carrying an NOL carryback is to get a refund on a company’s earlier years’ tax legal responsibility. From that cut-off date, the corporate can carry the amount again to the previous two years. If a high-revenue yr is on the horizon, it could be wise to defer utilizing NOL carryforwards to that 12 months to offset a bigger tax invoice. Conversely, in lean years with minimal revenue, applying NOLs will not be as helpful.

Bear In Mind, the carryforward quantity for the next tax 12 months is essentially the dollar determine you land on at Line 10 of the NOL Worksheet. It’s crucial that the worksheet reflects the calculations for under the NOL deduction’s related year that brings your taxable earnings to zero or beneath. Use Worksheet 2 to determine your carryover to 2024 if you had an NOL deduction from a 12 months before 2018 that resulted in your having taxable earnings on your 2023 return of zero or less. If your taxable earnings remains to be positive after application of the NOL deduction, there is no carryover to 2024. Particular rules apply for figuring the NOL carrybacks and carryovers of married individuals whose submitting status changes for any tax yr concerned in figuring an NOL carryback or carryover. Because NOLs have an result on whether or not you will be paying money taxes for years in the future, The money flow assertion of the 3-statement mannequin will be affected.

Estates and trusts that do not file Type 1045 must file an amended Form 1041 (instead of Type 1040-X) for each carryback 12 months to which NOLs are utilized. Use a copy of the appropriate year’s Kind 1041, check the “Net operating loss carryback” field, and follow the Form 1041 directions for amended returns. Embody the NOL deduction with other deductions not topic to the 2% limit (line 15a). Also, see the particular procedures for filing an amended return as a end result of an NOL carryback, defined under Form 1040-X, later.

This kind ends in a tentative adjustment of tax in the carryback year. If you carry back your NOL, you can use both Kind 1045 or Kind 1040-X. You can get your refund sooner by utilizing Kind 1045, but you have a shorter time to file it. If you utilize Form 1040-X, you should use a separate Form https://www.quickbooks-payroll.org/ 1040-X for every carryback yr to which you apply the NOL.

In common, the following objects usually are not allowed when figuring an NOL. If applicable, resolve whether to hold the NOL back to a past yr, or to waive the carryback period and instead carry the NOL ahead to a future 12 months. You should maintain data for any tax yr that generates an NOL and all years to which the loss could be carried for 3 years after you have used the carryback/carryforward or 3 years after the carryforward expires.

Carrying Ahead Excess Net Operating Loss

A internet working loss have to be brought on by certain deductions, like having a sluggish year with little revenue, property damages, pure disasters, excessive enterprise expenses, theft, transferring prices, and rental property bills. In conclusion, we will see the tax advantages steadily decline following the interval of unprofitability in 2019. By 2022, the NOL ending steadiness reverses (i.e., returns to zero) because the tax financial savings from the NOLs decline from $105k in 2019 to $21k.

Other Biws Courses Embrace:

If your NOL is more than your taxable revenue for the 12 months to which you carry it (figured before deducting the NOL), you may have an NOL carryover. You must make sure modifications to your taxable revenue to discover out how a lot NOL you will use up in that year and how much you presumably can carry over to the subsequent tax 12 months. Your carryover is the excess of your NOL deduction over your modified taxable income for the carryback or carryforward 12 months. If your NOL deduction contains more than one NOL, apply the NOLs against your modified taxable revenue in the identical order during which you incurred them, starting with the earliest. As A Outcome Of valuation allowance acts as a reserve, firm can decrease it from 12 months to year so as to decrease income tax expense, even the precise future tax deductions aren’t likely to happen. In impact, doing that is basically stealing from future income to find a way to prop current ones—when tax valuation allowances are calculated or changed improperly.

- CFI is the official supplier of the Business Banking & Credit Score Analyst (CBCA)™ certification program, designed to remodel anyone into a world-class financial analyst.

- A web operating loss (NOL) or tax loss carryforward is a tax provision that allows corporations to carry ahead losses from prior years to offset future earnings, and, due to this fact, decrease future income taxes.

- For instance, maybe the company received a service or product and listed the expense because of the accrual principle of accounting, however the firm is delaying money cost till the due date on the invoice.

- If it exceeds 80% of that year’s earnings, it may possibly then be used to offset a company’s tax funds in future tax periods utilizing an IRS tax provision known as loss carryforward.

- If your NOL deduction includes a couple of NOL, apply the NOLs towards your modified taxable income in the identical order by which you incurred them, starting with the earliest.

What Is A Internet Operating Loss (nol)?

Perhaps your projected gross sales didn’t match up with what was truly offered, otherwise you overspent too much in one certain area of the business. Notice that our MRY DTA attributable to NOL is computed using the assumed tax fee in the first projected interval, rather than the MRY tax fee. This ensures that the DTA attributable to NOL goes to zero when the NOL has been absolutely utilized. Attempt modifying this formulation to as a substitute link to the MRY tax fee what does nol stand for in accounting and observe that the DTA attributable to NOL does not go to zero in the first projected period.

Excess business losses which are disallowed are treated as an NOL carryover to the following tax 12 months. The current limitations on NOL carryforwards are primarily dictated by the Tax Cuts and Jobs Act and subsequent laws. You can offset solely as a lot as 80% of taxable revenue with NOLs in a given year for losses from 2018 onwards.

Don’t include on this line any part 1202 exclusion amounts (even if entered as a loss on Schedule D (Form 1041)). Carry the unused NOL to the subsequent carryback or carryforward yr and begin once more at Step four. Costs could embody overhead, operational expenses and value of products bought. The break-even point is when it brings in sufficient money to cowl all these prices.