Microfinance Software: Transforming Small-Scale Lending

Microfinance institutions (MFIs) play a pivotal role in providing financial access to underserved communities, entrepreneurs, and small businesses. However, managing micro-loans manually is cumbersome, prone to errors, and time-consuming. This is where Microfinance Software comes into play, revolutionizing the way MFIs operate.

Intelligrow Consultancy Services Pvt Ltd offers advanced microfinance solutions designed to simplify loan management, enhance operational efficiency, and improve customer satisfaction.

What is Microfinance Software?

Microfinance Software (MFS) is a digital platform that automates the end-to-end operations of microfinance institutions. It helps manage small loans, track repayments, maintain records, and generate reports—all in a secure and organized manner.

Traditionally, MFIs relied heavily on manual processes, which often led to delayed approvals, human errors, and poor tracking. With Microfinance Software, institutions can manage multiple borrowers efficiently, ensuring transparency and timely lending.

Key Features of Microfinance Software

Modern Microfinance Software comes with a variety of features that empower MFIs to streamline operations and serve their clients better.

1. Loan Management

The software automates the loan lifecycle—from application submission to disbursement and repayment tracking. MFIs can set customized repayment schedules, monitor overdue loans, and generate automatic reminders.

2. Client Management

MFS maintains a centralized database of all borrowers, including personal information, loan history, and repayment patterns. This allows institutions to understand client behavior and provide better services.

3. Automated Accounting

Integrated accounting modules enable automatic bookkeeping, balance sheet generation, and financial reporting. This reduces manual errors and ensures accurate financial management.

4. Risk Assessment and Credit Scoring

Advanced analytics and algorithms evaluate borrower creditworthiness, helping MFIs make informed lending decisions. Automated risk assessment reduces defaults and ensures responsible lending.

5. Reporting and Analytics

With real-time dashboards and customizable reports, MFIs can track performance, loan portfolio health, and growth metrics. Data-driven insights allow management to make strategic decisions efficiently.

6. Compliance and Security

Microfinance institutions must comply with strict regulations. Microfinance Software ensures all operations are audit-ready, maintains secure borrower data, and meets regulatory standards.

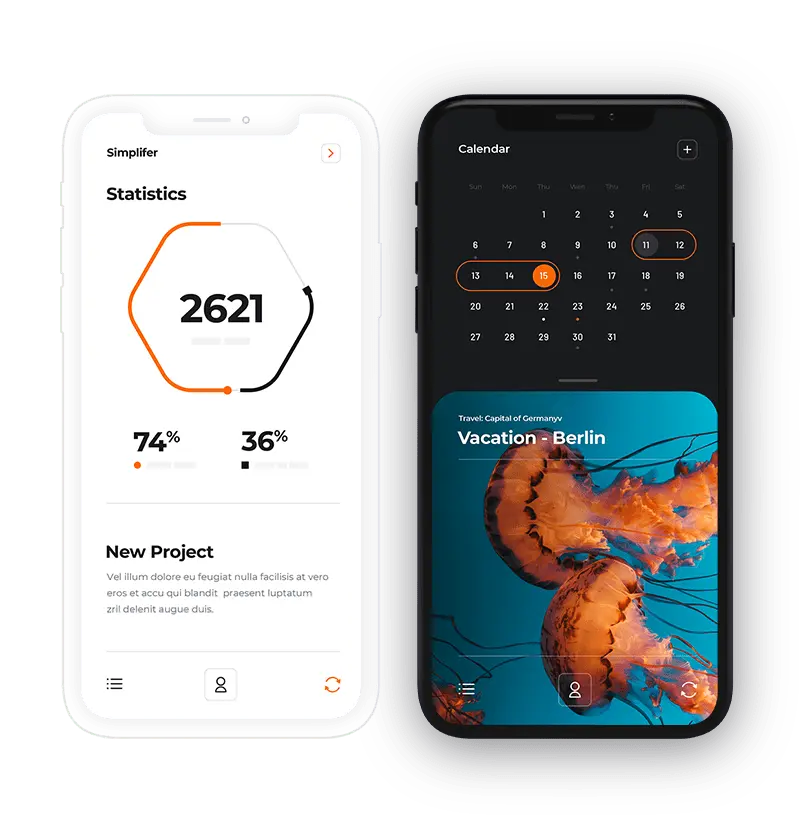

7. Mobile Integration

Many modern MFS solutions include mobile applications for both staff and borrowers. This enables remote loan application, real-time tracking, and easy repayment options—enhancing accessibility for clients in rural areas.

Benefits of Implementing Microfinance Software

Adopting Microfinance Software provides numerous advantages for MFIs, helping them operate efficiently while serving their clients better.

1. Faster Loan Processing

Automation reduces manual paperwork, allowing MFIs to process loans faster. Clients experience quick approvals, which builds trust and strengthens relationships.

2. Increased Accuracy

Manual operations are prone to mistakes that can affect repayments and reporting. Microfinance Software ensures accurate calculations, proper record-keeping, and minimal errors.

3. Improved Risk Management

Automated credit scoring and risk assessment help MFIs evaluate borrowers carefully, reducing default rates and promoting responsible lending practices.

4. Cost Efficiency

By streamlining processes and reducing administrative workload, MFS helps institutions save time and money. Operational efficiency leads to higher profitability and sustainability.

5. Enhanced Customer Experience

A digital platform allows borrowers to track loans, make repayments online, and communicate seamlessly with staff. This convenience improves satisfaction and retention rates.

6. Regulatory Compliance

Built-in compliance tools ensure all lending activities adhere to legal and regulatory requirements. This reduces the risk of penalties and ensures transparent operations.

How Intelligrow Consultancy Services Pvt Ltd Enhances Microfinance Operations

Intelligrow Consultancy Services Pvt Ltd specializes in delivering Microfinance Software tailored to the needs of modern MFIs. Here’s how their solutions stand out:

-

Customizable Solutions: The software adapts to the unique workflows of each institution, ensuring seamless operations.

-

Advanced Technology: Leveraging AI, cloud computing, and data analytics, Intelligrow provides faster loan processing and accurate credit assessment.

-

Seamless Integration: MFS integrates effortlessly with existing accounting and banking systems, reducing operational challenges.

-

Secure and Compliant: Data protection and regulatory compliance are built into every module of the software.

-

User-Friendly Interface: Both staff and borrowers enjoy an intuitive interface that simplifies operations and enhances accessibility.

Industries That Benefit from Microfinance Software

While primarily designed for MFIs, Microfinance Software can be used across various financial and lending sectors:

-

Microfinance Institutions: Efficiently manage small-scale lending and repayments.

-

Non-Banking Financial Companies (NBFCs): Streamline loan approvals and client management.

-

Credit Cooperatives: Improve transparency, track contributions, and manage member loans.

-

NGOs Providing Financial Aid: Track disbursements, manage beneficiaries, and generate impact reports.

-

Rural Lending Organizations: Enable digital access to financial services for remote populations.

Implementing MFS allows these organizations to reduce errors, optimize operations, and improve customer engagement.

Key Considerations When Choosing Microfinance Software

Selecting the right MFS is crucial for maximizing efficiency and client satisfaction. Consider the following factors:

-

Scalability: The software should grow with your organization’s needs.

-

Integration: Ensure compatibility with existing systems and third-party services.

-

Ease of Use: Staff and clients should find the platform intuitive and accessible.

-

Security: Protect sensitive data with robust encryption and access control.

-

Support and Maintenance: Reliable vendor support ensures smooth operation and timely updates.

Intelligrow Consultancy Services Pvt Ltd excels in meeting all these requirements, offering scalable, secure, and user-friendly microfinance solutions.

The Future of Microfinance Software

The future of micro-lending is digital, and Microfinance Software is leading the way. Cloud-based platforms, mobile-first applications, and AI-driven analytics are shaping the landscape of microfinance operations.

Financial institutions leveraging MFS gain multiple advantages:

-

Reduced operational costs

-

Faster and accurate loan processing

-

Improved borrower experience

-

Enhanced risk management

-

Data-driven strategic insights

As technology evolves, MFIs using modern Microfinance Software will stay competitive, improve outreach, and contribute to financial inclusion more effectively.

Conclusion

Microfinance Software is essential for MFIs aiming to enhance efficiency, reduce errors, and provide better service to their clients. Intelligrow Consultancy Services Pvt Ltd delivers advanced solutions that automate loan processes, ensure compliance, and empower institutions to operate digitally.

Investing in modern MFS transforms traditional lending into a streamlined, transparent, and scalable process. With Intelligrow’s Microfinance Software, financial institutions can expand their reach, improve borrower satisfaction, and achieve operational excellence.