Software for Microfinance: Transforming Financial Operations with Intelligrow Consultancy Services Pvt Ltd

In today’s rapidly evolving financial landscape, microfinance institutions face unique challenges. Managing multiple clients, monitoring loans, ensuring compliance, and maintaining transparency can be overwhelming without the right tools. This is where Software for Microfinance by Intelligrow Consultancy Services Pvt Ltd comes into play. Designed to simplify operations, improve efficiency, and enhance customer satisfaction, this software is a game-changer for institutions seeking sustainable growth.

Streamline Operations with Software for Microfinance

One of the primary benefits of implementing Software for Microfinance is operational efficiency. Traditional processes often involve manual data entry, time-consuming calculations, and repetitive paperwork. These methods not only slow down work but also increase the risk of errors. Intelligrow’s solution automates key processes such as loan disbursement, repayment tracking, client data management, and reporting.

By centralizing all operations in one platform, microfinance institutions can focus more on serving clients and expanding outreach rather than managing cumbersome administrative tasks. This transformation ensures faster service delivery, improved accuracy, and reduced operational costs.

Real-Time Tracking and Reporting

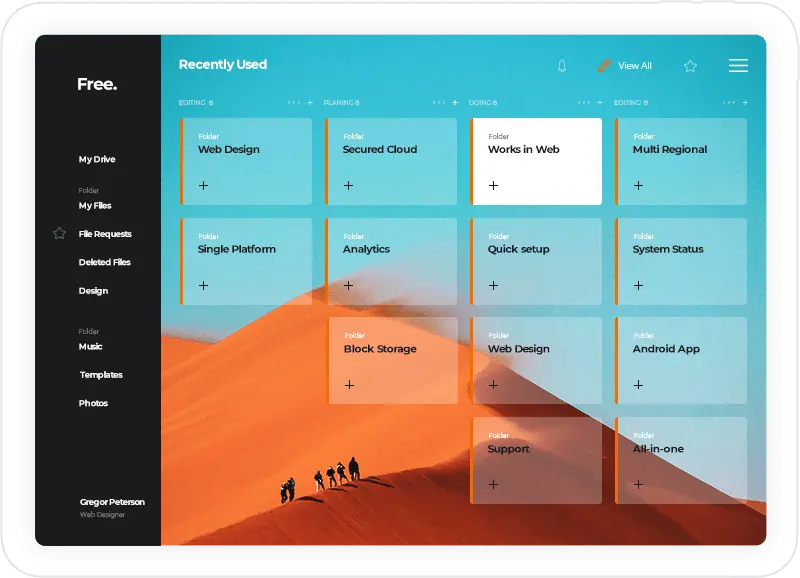

In microfinance, monitoring loans and repayments is crucial. Software for Microfinance offers real-time tracking of all financial transactions, allowing institutions to make informed decisions quickly. With dynamic dashboards and detailed reports, management can analyze loan performance, detect defaults early, and identify trends for strategic planning.

Additionally, this software provides customizable reporting options. Whether it’s generating weekly loan summaries, tracking delinquency rates, or preparing compliance reports, everything is just a few clicks away. The transparency offered by the software ensures accountability and builds trust with stakeholders.

Enhancing Client Relationship Management

A successful microfinance institution thrives on strong client relationships. Intelligrow’s Software for Microfinance includes robust client management tools to store detailed customer profiles, track loan histories, and maintain communication records. This holistic view of client interactions allows institutions to offer personalized services and proactive support.

For instance, automated reminders for upcoming repayments and alerts for overdue payments help clients stay informed while reducing the workload for staff. By improving communication and service delivery, institutions can enhance customer loyalty and build a stronger reputation in the community.

Compliance Made Easy

Microfinance institutions operate under strict regulatory frameworks. Non-compliance can lead to penalties, reputational damage, or even closure. Software for Microfinance ensures adherence to all regulatory requirements by automating compliance checks and maintaining audit-ready records.

From tracking interest rates and maintaining client consent to generating regulatory reports, the software simplifies compliance management. Institutions can operate confidently, knowing they are aligned with government regulations and industry best practices.

Scalability and Customization

Every microfinance institution has unique needs, and Intelligrow’s Software for Microfinance is designed to adapt. Whether you are managing a small community-based organization or a multi-branch financial institution, the software can scale according to your requirements.

Customizable modules allow institutions to select features relevant to their operations, such as micro-loans, group lending, savings management, or financial analytics. This flexibility ensures that the software remains effective as your institution grows, eliminating the need for frequent upgrades or new systems.

Data Security and Reliability

In financial services, data security is paramount. The software by Intelligrow prioritizes the safety of client information and financial records. Advanced encryption methods, role-based access controls, and regular backups safeguard sensitive data from unauthorized access or loss.

Reliability is another key feature. With cloud-based options and robust infrastructure, institutions can access real-time data anytime, anywhere. This not only improves decision-making but also ensures business continuity during unforeseen events.

Why Choose Intelligrow Consultancy Services Pvt Ltd?

Intelligrow Consultancy Services Pvt Ltd is a trusted provider of financial software solutions. Their expertise in microfinance, combined with cutting-edge technology, ensures that institutions receive a product that addresses all operational challenges. With user-friendly interfaces, seamless integrations, and dedicated support, adopting their Software for Microfinance becomes a hassle-free experience.

Institutions that leverage this software gain a competitive edge by reducing operational inefficiencies, improving client satisfaction, and maintaining regulatory compliance effortlessly.

Conclusion

For microfinance institutions aiming for efficiency, accuracy, and growth, investing in Software for Microfinance by Intelligrow Consultancy Services Pvt Ltd is a strategic decision. By automating processes, enhancing client relationships, ensuring compliance, and offering scalability, this software empowers institutions to focus on their core mission – financial inclusion and sustainable development.

With technology driving the future of finance, microfinance institutions that embrace software solutions can achieve operational excellence and long-term success. Make the shift today and experience the transformative power of Intelligrow’s Software for Microfinance.