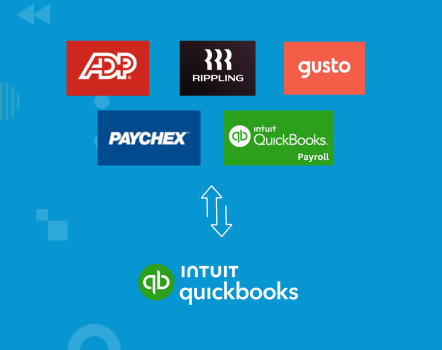

Both ADP and QuickBooks Payroll provide full-service payroll, can grow along with your small enterprise, and feature HR integrations. Get in contact with our QuickBooks specialists at present and they are going to solve your query immediately. Nonetheless, after comparing the general capabilities of QuickBooks Payroll and ADP, we realized the latter emerges because the main platform.

ADP’s suite of user-friendly instruments embody advanced state unemployment insurance administration instruments. The integration of ADP with QuickBooks Online ensures the provision of accurate financial knowledge, enabling knowledgeable decision-making and monetary evaluation for business operations and planning. The integration of ADP with QuickBooks On-line minimizes the occurrence of human errors in payroll and monetary data administration, ensuring larger accuracy and reliability in records. By mapping the worker knowledge fields between ADP and QuickBooks On-line, you ensure that employee info, such as hours worked and wages, is precisely transferred.

Taxes And Compliance

QuickBooks Payroll partners with 3rd get together suppliers to offer health insurance, workers’ compensation, and retirement plans. Ultimately, this integration interprets into enhanced efficiencies, price financial savings, and better strategic planning, offering companies with a competitive edge in today’s dynamic markets. As a outcome, there is a notable reduction in manual errors and the potential for increased productiveness throughout the organization. The effort and time saved through this integration can be redirected in path of different essential enterprise actions, fostering operational agility and progress.

Determine What Payroll Features You Want

This software additionally permits for simple collaboration between accountants and business owners, making it a valuable tool for maintaining correct monetary information and guaranteeing compliance with tax laws. Many trendy payroll software options are designed to streamline payroll processing, scale back errors, and ensure compliance with ever-changing tax legal guidelines and regulations. By investing in reliable payroll software, you can adp quickbooks decrease the chance of costly mistakes and penalties, whereas maximizing effectivity and accuracy in your payroll operations.

By enabling the integration of ADP with QuickBooks Online, businesses can streamline their payroll and monetary administration whereas maintaining the best standards of knowledge security. The authorization course of is essential for shielding delicate information and sustaining compliance with knowledge privacy rules. ADP will work with you to determine the right payroll set-up for your small business, regardless of how easy or complex your needs are. ADP (Automatic Knowledge Processing) is a global chief in payroll and HR solutions https://www.quickbooks-payroll.org/.

Frequently updating and reconciling the integrated data is crucial for sustaining accuracy and consistency throughout both platforms. So far, everything I even have skilled with ADP has been incredible. ADP made it super simple to transition and each step of the finest way, each want has been met. Click through our self-led demo to see how straightforward payroll and HR could be.

- You can depend on ADP’s fast, friendly, and educated customer service representatives to help implementation and beyond.

- The ensuing efficiency positive aspects not solely save time but also reduce the chance of costly errors, resulting in smoother payroll operations and improved overall enterprise efficiency.

- From there, you might be prompted to enter your ADP credentials and authorize the connection.

- Track time, run payroll if you need with same-day direct deposit, automate tedious duties, and more.

It’s essential to ensure that all worker information, including hours labored, wages, deductions, and taxes, is accurately transferred from ADP to QuickBooks. Though some individuals favor to attend for the beginning of a model new quarter, or perhaps a new 12 months, earlier than switching over to a brand new payroll service supplier, ADP can assist your move at any time. Any high-quality supplier should be succesful of provide you with a clear listing of varieties and data you’ll must make a clean transition. Our previous payroll provider made too many mistakes, requiring us to double-check their work.

With ADP, that’s now not an issue, and it provides me peace of mind knowing I can trust the service we obtain. ADP provides a broader range of integration capabilities with numerous HR and accounting techniques, whereas QuickBooks Payroll is specifically designed to integrate seamlessly with QuickBooks accounting software program. You can depend on ADP’s quick, pleasant, and educated customer service representatives to help implementation and beyond.

QuickBooks has discontinued the utilization of its payroll service with QuickBooks Desktops that have variations older than 2020. Nonetheless, QuickBooks continues to supply its payroll services and lets you use it alongside its different merchandise, including QuickBooks Accounting and QuickBooks Time. Note, every QuickBooks Stay offering requires an energetic QuickBooks Online subscription and extra phrases, circumstances, limitations and fees apply. For more information about companies supplied by Stay Bookkeeping, discuss with the QuickBooks Phrases of Service. QuickBooks provides live phone and chat assist six days per week, offering you with a direct line to consultants everytime you need them.

In distinction, ADP does not disclose its pricing info upfront. To get hold of a quote, organizations must contact ADP’s gross sales team and supply them with the details about their business measurement and wishes. Examine Paycom vs. ADP to decide on the most effective payroll different for your corporation. Rippling and its affiliates do not provide tax, accounting, or legal recommendation. This materials has been prepared for informational functions solely, and is not intended to provide or be relied on for tax, accounting, or authorized advice.