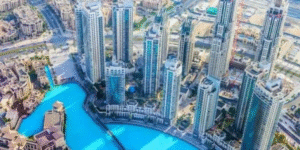

Dubai Real Estate

If you’ve ever dreamed of owning a slice of the UAE, chances are you’ve looked at Dubai Real Estate. The city has become a global magnet for investors, homebuyers, and lifestyle seekers alike. From waterfront penthouses overlooking the Burj Khalifa to family-friendly townhouses in gated communities, Dubai’s property market offers a mix of glamour, comfort, and serious investment potential. It’s not just the luxury appeal; it’s the strong rental yields, the tax-free environment, and the promise of long-term growth that keep investors coming back.

At the same time, buyers are increasingly drawn toward Off Plan Projects in Dubai. These developments—purchased before construction is complete—open the door to attractive prices, flexible payment plans, and the excitement of owning a future-ready property. Imagine booking a unit today and watching your investment grow even before handover. For many, that’s where the real thrill of Dubai’s property scene begins.

Why Dubai Real Estate Is Different from Anywhere Else

When you talk about property markets worldwide, you’ll notice most cities are tied closely to their local economies. Dubai, however, plays on an entirely different stage. The emirate is a global hub for business, travel, and tourism, attracting people from more than 200 nationalities. This cosmopolitan influx creates a constant demand for rental and ownership opportunities.

For example, an IT consultant from London might rent a one-bedroom apartment in Downtown Dubai for a year, while a family from India could settle into a four-bedroom villa in Arabian Ranches. These varied demands keep the market dynamic. Investors don’t just rely on local tenants—Dubai’s appeal ensures there’s always a steady stream of professionals, entrepreneurs, and tourists looking for a place to stay.

Add in government initiatives like the Golden Visa program, 100% foreign ownership in designated freehold areas, and world-class infrastructure, and you’ll see why Dubai real estate consistently ranks as one of the most attractive investment destinations on the planet.

Freehold vs Leasehold: What Buyers Should Know

One of the first things newcomers notice is that Dubai offers two types of ownership: freehold and leasehold.

-

Freehold properties allow you to own the property outright, with your name on the title deed. These are mainly in designated areas such as Dubai Marina, Palm Jumeirah, Downtown Dubai, and Dubai Hills Estate. For international buyers, freehold is the most common route.

-

Leasehold properties, on the other hand, grant ownership for a fixed period—usually 99 years. Once the lease expires, ownership reverts to the freeholder unless renewed.

Both options have their place. For instance, a leasehold property might come at a slightly lower upfront cost, making it ideal for first-time investors testing the waters. Freehold, meanwhile, is popular among those seeking long-term appreciation and generational ownership.

Exploring Off Plan Projects in Dubai

Off plan properties have become one of the hottest segments in the market. Why? Because they combine affordability with future promise. Buyers often enjoy lower entry prices, flexible payment plans (sometimes as low as 1% per month), and higher appreciation once the project is completed.

For example, take an off plan launch by Emaar in Dubai Hills Estate. A buyer who books a two-bedroom apartment at launch could lock in a price significantly below the market value at handover. By the time construction is finished, the property might already be worth 15–20% more, thanks to market growth and increased demand.

Of course, it’s not just about numbers. Off plan homes also offer cutting-edge designs, smart-home features, and modern community planning. Whether it’s a waterfront project in Business Bay or a family-oriented development in Jumeirah Village Circle, off plan options reflect the evolving lifestyle needs of Dubai’s diverse residents.

Best Areas for Dubai Real Estate Investment

With so many neighborhoods, choosing the right area can feel overwhelming. Here are a few standout communities:

Downtown Dubai

Home to the Burj Khalifa and Dubai Mall, Downtown is the city’s beating heart. Apartments here promise strong rental yields and unparalleled lifestyle perks.

Dubai Marina

A waterfront haven, Dubai Marina is a favorite among professionals and tourists. Its high-rise towers, restaurants, and yacht clubs make it a vibrant investment choice.

Palm Jumeirah

Arguably Dubai’s most iconic development, the Palm offers luxury villas, branded residences, and some of the best beachfront living in the world.

Dubai Hills Estate

Known as the “green heart of Dubai,” this master community blends modern living with parks, golf courses, and schools. It’s particularly popular among families.

Business Bay

Often compared to Manhattan, Business Bay combines commercial hubs with stylish residential towers. Proximity to Downtown makes it highly desirable for investors.

Key Factors Driving Dubai’s Property Market

Several elements keep fueling growth in Dubai real estate:

-

Population Growth: Dubai’s population is expected to nearly double by 2040.

-

Infrastructure Development: From the Dubai Metro expansion to futuristic projects like flying taxis, infrastructure plays a big role in property demand.

-

Tax Benefits: No income tax, no capital gains tax, and no property tax—investors keep more of their returns.

-

Tourism and Events: Dubai Expo 2020 may be over, but global events, conferences, and year-round tourism continue to boost demand.

-

Stable Regulations: The Dubai Land Department (DLD) and RERA ensure transparency and security in transactions, giving investors peace of mind.

Living in Dubai: More Than Just Investment

It’s easy to think of Dubai only in terms of numbers, but life here is more than spreadsheets and ROI. The city offers world-class schools, hospitals, shopping malls, and leisure attractions. You can spend Friday mornings at Kite Beach, afternoons shopping at Mall of the Emirates, and evenings enjoying concerts at Coca-Cola Arena.

The safety factor also cannot be overstated. Dubai consistently ranks as one of the safest cities in the world. Families, singles, and retirees alike find comfort in knowing their neighborhood is secure.

Tips for First-Time Buyers

If you’re entering Dubai’s real estate market for the first time, here are a few practical tips:

-

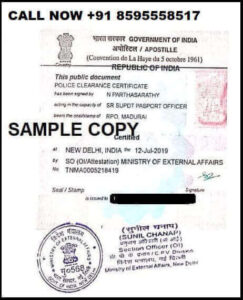

Work with a trusted agency: Look for RERA-registered brokers who can guide you through the legalities.

-

Know your budget: Don’t just focus on property prices—consider service charges, DLD fees, and furnishing costs.

-

Research developers: Established names like Emaar, Nakheel, and Dubai Properties have strong track records.

-

Think long term: Whether it’s rental yields or capital appreciation, plan for at least 5–10 years.

-

Visit the community: Before buying, spend a day in the neighborhood. Have a coffee at a local café, walk through the park, and get a feel for the place.

Frequently Asked Questions (FAQs)

1. Is Dubai Real Estate a good investment in 2025?

Yes. With strong population growth, global appeal, and tax advantages, Dubai real estate continues to offer high rental yields and long-term appreciation.

2. Can foreigners buy property in Dubai?

Absolutely. Foreigners can purchase freehold properties in designated areas like Downtown, Marina, Palm Jumeirah, and more.

3. What are the benefits of Off Plan Projects in Dubai?

Off plan properties usually come with lower prices, flexible payment plans, and higher appreciation potential once completed.

4. How do property transactions work?

All transactions go through the Dubai Land Department (DLD) to ensure transparency. Buyers and sellers must use RERA-registered brokers.

5. What is the Golden Visa and how is it linked to property?

Investors who purchase properties above a certain value may qualify for a 10-year renewable Golden Visa, offering residency benefits.

6. Are mortgages available for expatriates?

Yes. Many banks in Dubai offer mortgage options for expats, though requirements may vary depending on income and residency status.

7. What is the average ROI in Dubai real estate?

Rental yields typically range from 5% to 8%, which is higher than many global property markets.

8. What is the minimum amount required to invest?

Some off plan projects start as low as AED 500,000, with booking amounts around 10–20%.

9. Are service charges expensive?

Service charges depend on the community and amenities. Luxury towers might have higher fees, while suburban villas often cost less.

10. How safe is it to invest in off plan?

With reputable developers and DLD-approved escrow accounts, risks are minimized. Always verify the project’s status before investing.

11. Do properties come furnished?

Some developments offer fully furnished units, especially branded residences. Most, however, are delivered unfurnished.

12. Can I buy property using cryptocurrency?

Yes, many developers now accept cryptocurrency payments, reflecting Dubai’s forward-thinking approach.

13. What happens if I want to sell before completion?

Off plan properties can often be resold, though the developer’s policies and payment schedule will determine your options.

14. Are there hidden costs in buying property?

Aside from the purchase price, buyers should factor in DLD registration fees (4% of property value), agent commission, and maintenance fees.

15. Is Dubai only for luxury buyers?

Not at all. While Dubai is famous for its luxury, there are plenty of affordable apartments, townhouses, and mid-range options for budget-conscious investors.

Conclusion

Dubai real estate is more than just skyscrapers and glittering views. It’s a market built on strong fundamentals, forward-thinking governance, and a vision that stretches decades into the future. Whether you’re exploring off plan projects in Dubai for a smart entry or investing in a freehold villa on the Palm, the opportunities are as diverse as the city itself.

For investors, expats, or families considering a move, one thing is clear: Dubai isn’t just a place to live—it’s a place to grow, prosper, and be part of a global success story.