Market Overview 2025-2033

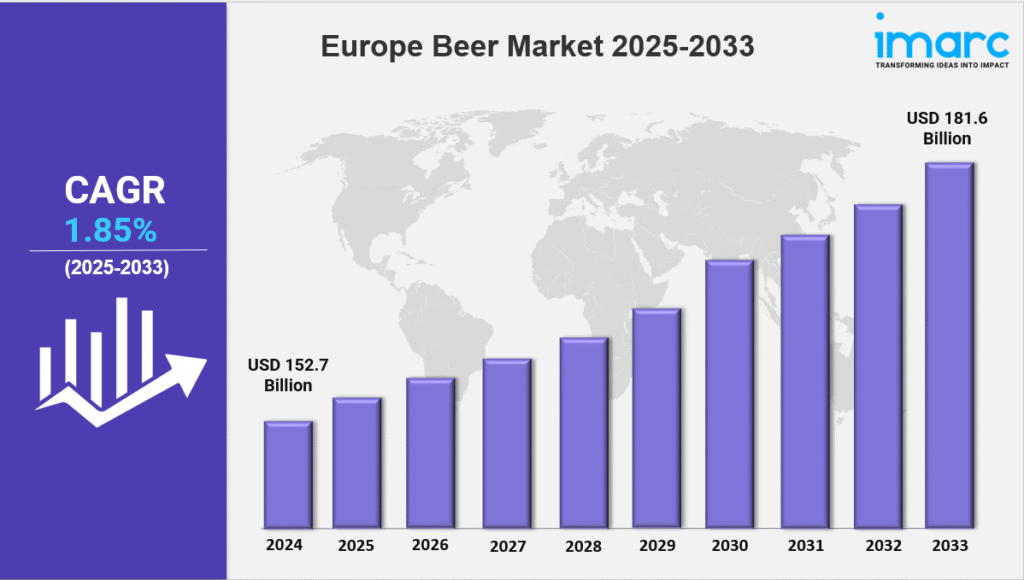

The Europe beer market size was valued at USD 152.7 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 181.6 Billion by 2033, exhibiting a CAGR of 1.85% from 2025-2033. The market is expanding due to rising consumer demand, craft beer trends, and premium product innovations. Sustainability initiatives, changing preferences, and technological advancements are driving growth, making it a dynamic and competitive industry.

Key Market Highlights:

✔️ Steady market growth driven by rising demand for craft, premium, and low-alcohol beers

✔️ Increasing consumer preference for sustainable and locally brewed beer options

✔️ Expanding distribution through e-commerce, breweries, and specialty retail stores

Request for a sample copy of the report: https://www.imarcgroup.com/europe-beer-market/requestsample

Europe Beer Market Trends and Drivers:

The Europe beer market is undergoing a significant transformation as consumer preferences shift toward craft, premium, and health-conscious options. In 2024, craft beer sales surged by 12%, despite ongoing price increases and supply chain challenges. Across major beer-producing countries like Germany, the UK, and Belgium, consumers are moving away from mass-produced labels in favor of locally brewed, high-quality offerings. This trend is reshaping the Europe beer market share, prompting major brewers to acquire craft brands or develop their own premium lines to stay competitive.

However, the industry is not without its challenges. Rising production costs, tighter advertising regulations—particularly in Nordic countries—and increasing pressure to adopt sustainable practices are forcing brewers to adapt. Over 60% of breweries in Europe have implemented greener processes, such as energy-efficient brewing and sustainable sourcing. Carlsberg’s “Together Towards Zero” initiative, which targets carbon neutrality by 2040, exemplifies how sustainability is becoming central to business strategy and growth in the European beer market size.

Health and wellness trends are also driving major shifts in consumer behavior. Sales of low- and no-alcohol beers rose by 18% in 2024, with Spain and the Netherlands leading the charge. Heineken reports that alcohol-free beers now account for nearly 30% of its European sales. In support of these changes, the EU has introduced tax incentives for beers under 3.5% ABV, encouraging breweries to innovate and helping healthier options gain momentum.

Small breweries continue to face intense competition from large multinational brands with deeper advertising budgets and faster product development cycles. To carve out a niche, many independents are emphasizing sustainability—utilizing recyclable packaging, water reuse systems, and renewable energy. The EU’s ban on single-use plastics has further driven innovation, with major players like AB InBev exploring alternatives such as edible beer rings. However, today’s consumers demand authenticity, pushing brands to go beyond greenwashing and demonstrate real environmental commitment.

The Europe beer market stands out for its blend of tradition and innovation. While craft and premium offerings often revisit historic brewing techniques, the rising popularity of low- and no-alcohol and functional beers—infused with adaptogens or vitamins—reflects the values of younger, health-conscious drinkers. Even smaller breweries are expanding into alcohol-free options to meet growing demand.

Consumer tastes remain highly regional. Southern Europe favors lighter, easy-drinking beers, while Northern countries like Denmark and Finland are seeing a rise in wellness-driven beers with added functional ingredients. Digital channels are also reshaping the landscape, with beer subscription services growing by 22% in 2024. Still, local pubs and taprooms remain vital touchpoints for customer engagement and brand loyalty.

Looking ahead, the European beer market outlook remains positive. Future growth will depend on how effectively breweries respond to evolving consumer demands, manage costs, and advance sustainability efforts. According to the latest European beer market report, those that innovate and adapt swiftly are best positioned to thrive. The expanding European beer market size signals strong industry momentum and resilience in the face of change.

Europe Beer Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Analysis by Product Type:

- Standard Lager

- Premium Lager

- Specialty Beer

- Others

Analysis by Packaging:

- Glass

- PET Bottle

- Metal Can

- Others

Analysis by Production:

- Macro-Brewery

- Micro-Brewery

- Others

Analysis by Alcohol Content:

- High

- Low

- Alcohol-Free

Analysis by Flavor:

- Flavored

- Unflavored

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- On-Trades

- Specialty Stores

- Convenience Stores

- Others

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145