IMARC Group has recently released a new research study titled “Mexico Pest Control Market Size, Share, Trends and Forecast by Type, Pest Type, Application, and Region, 2025-2033,” which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Mexico Pest Control Market Overview

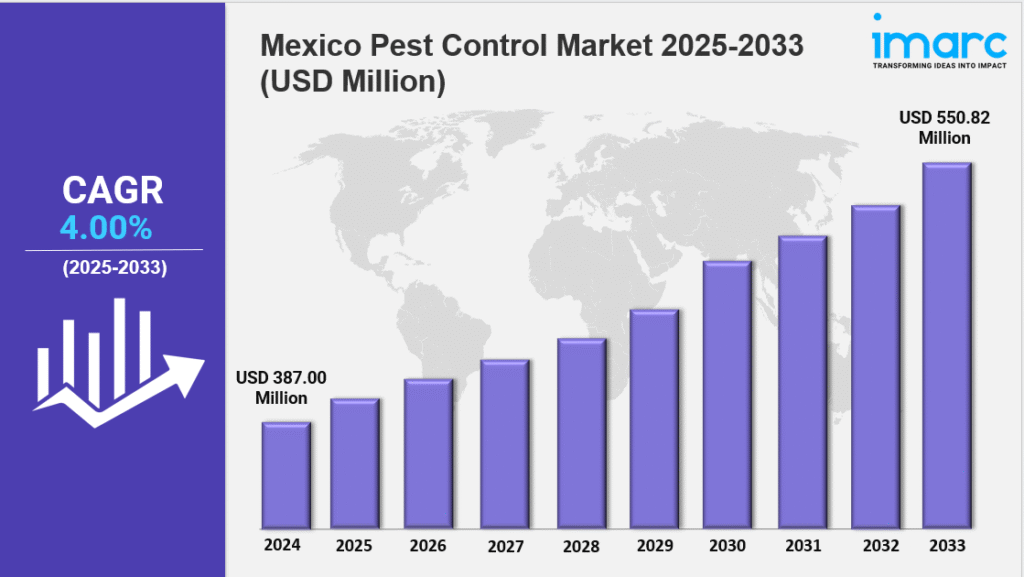

The Mexico pest control market size reached USD 387.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 550.82 Million by 2033, exhibiting a growth rate (CAGR) of 4.00% during 2025-2033.

Market Size and Growth

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 387.00 Million

Market Forecast in 2033: USD 550.82 Million

Market Growth Rate 2025-2033: 4.00%

Request for a sample copy of the report: https://www.imarcgroup.com/mexico-pest-control-market/requestsample

Key Market Highlights:

✔️ Increasing urbanization and public health awareness driving demand for pest control services

✔️ Rising adoption of eco-friendly and non-toxic pest control solutions

✔️ Growth in commercial and residential real estate fueling market expansion

Mexico Pest Control Market Trends

The Mexico pest control market is experiencing robust growth, driven by rapid urbanization and heightened attention to public health. With over 80% of the population now residing in urban areas, cities like Mexico City, Guadalajara, and Monterrey face intensifying pest-related challenges. Common pests such as rodents, cockroaches, and mosquitoes pose significant health risks, including outbreaks of dengue and leptospirosis.

In 2024, the federal government allocated MXN 2.3 billion to municipal pest control initiatives. This investment supports integrated pest management (IPM) strategies that combine chemical treatments with environmental adjustments. Regulatory changes now require commercial developers to implement termite prevention methods before construction, resulting in an 18% year-over-year increase in structural pest control revenue. The hospitality and healthcare sectors, in particular, are fueling Mexico pest control market demand, now comprising 34% of overall service use. Premium services are growing steadily at a 4.00% compound annual growth rate (CAGR).

Climate Change Accelerates Agricultural Pest Pressures

Erratic weather patterns have reshaped pest dynamics across Mexico’s 24.6 million-hectare agricultural zone. In 2024 alone, there was a 40% increase in fall armyworm infestations in maize fields and a surge in whitefly outbreaks in tomato greenhouses. The Ministry of Agriculture estimates crop losses due to invasive species reached MXN 14.7 billion, prompting the adoption of precision pest control technologies. Today, 12% of commercial farms utilize drones with multispectral sensors for targeted bio-pesticide applications, such as Beauveria bassiana.

Meanwhile, USMCA trade restrictions on neonicotinoids have accelerated the growth of biological control agents, with production up 300% since 2021. However, adoption remains low among smallholder farmers—only 8% use advanced methods like pheromone traps or pest-resistant crops despite available subsidies. This disparity in access widens the gap between high-tech regions like Sinaloa, which reports 92% pest suppression using AI-driven forecasting, and subsistence regions like Oaxaca, where locust outbreaks remain common.

Eco-Conscious Consumers Reshape Residential Demand

Sustainability is playing an increasingly important role in Mexico pest control market growth. Approximately 63% of urban households now prefer non-toxic, eco-friendly pest control solutions. Following the 2024 ban on chlorpyrifos due to its links to neurodevelopmental issues, the market saw a surge in demand for plant-based repellents and ultrasonic devices, which now hold 19% of market share.

Startups such as BioPlag and EcoTrap are pioneering chemical-free solutions, offering heat treatments for bed bug removal with 99.4% efficacy. Public concern over pollinator safety has created an USD 87 million niche in pollinator-safe pest control—especially relevant in avocado and citrus-growing regions. However, this green transition coexists with a burgeoning black market for counterfeit pesticides, valued at MXN 6.9 billion annually. Regulatory authorities struggle to balance affordability with ecological responsibility, as organic alternatives remain 3.2 times more expensive than conventional sprays for most households.

Mexico Pest Control Market Trajectory: Opportunities and Challenges

The Mexico pest control market is evolving into a USD 1.2 billion ecosystem that reflects both innovation and fragmentation. The 2024 ratification of the National Integrated Vector Management Policy marked a significant policy milestone, signaling stronger governmental intent to regulate and modernize pest control practices.

Yet, implementation remains inconsistent. While corporate clients deploy advanced technologies like AI-enabled rodent detectors—now active in Mexico City’s metro system—74% of municipal programs still rely on manual spraying teams. Climate projections suggest termite activity will increase by 27% by 2030, pushing investment into novel biocontrols such as cellulose-eating nematodes, although regulatory approvals lag.

Medical tourism near the U.S. border is also increasing Mexico pest control market demand, especially for hospital-grade disinfection services that are growing at 31% annually. However, rural health centers still lack even basic mosquito control tools. These contrasts illustrate the sector’s dual-speed evolution, as global standards meet local constraints.

Market Key Players in the Mexico Pest Control Industry

Several companies are shaping the current and future landscape of the Mexico pest control market:

- Rentokil Initial – A global leader expanding its footprint in Mexico through acquisitions of local providers, especially in commercial and healthcare segments.

- Fumigaciones Integrales de México – A major domestic player known for structural and industrial pest management.

- BioPlag – An eco-friendly startup specializing in heat treatment and biological pest control solutions.

- EcoTrap – Innovating in ultrasonic and non-chemical pest control devices for residential and small commercial use.

- Bayer Crop Science Mexico – Active in the agricultural sector with a growing line of biological products, adapting to stricter regulations on synthetic chemicals.

These players are capitalizing on the Mexico pest control market growth by innovating across technology, sustainability, and regulatory compliance.

Mexico Pest Control Market Segmentation:

The market report segments the market based on product type, distribution channel, and region:

Breakup by Type:

- Chemical

- Mechanical

- Biological

- Others

Breakup by Pest Type:

- Insects

- Termites

- Rodents

- Others

Breakup by Application:

- Residential

- Commercial

- Agriculture

- Industrial

- Others

Breakup by Region:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Ask Analyst & Browse Full Report with TOC & List of Figures: https://www.imarcgroup.com/request?type=report&id=33904&flag=C

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Key Highlights of the Report

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91-120-433-0800

United States: +1 201971-6302