Income Tax

As an NRI (Non-Resident Indian), navigating India’s income tax rules can feel overwhelming. With sources like rental income, investments, or pensions flowing from India, understanding NRI Income Tax is crucial to avoid penalties and optimize your returns. In this guide, we’ll break down everything—from residency status to using an Income Tax Calculator and TDS Calculator—so you can file Income Tax returns confidently.

Whether you’re earning from property in Mumbai or dividends from Indian stocks, staying compliant ensures peace of mind. Let’s dive in.

What Defines an NRI Under Income Tax Rules?

The Income Tax Act, 1961, classifies you as an NRI if you meet any of these criteria in a financial year (April 1 to March 31):

- You’re not in India for 182 days or more.

- You’re in India for 60 days or more and 365 days or more in the prior four years (this 60-day rule is relaxed for Indian citizens leaving for employment abroad or as crew members).

Key Tip: Use the Income Tax Department’s residency calculator on their portal to confirm your status. NRIs are taxed only on India-sourced income, unlike Residents who face global taxation.

What Income is Taxable for NRIs?

NRIs pay tax on income “received or deemed to be received” in India, or “accruing or arising” here. Common heads include:

- Salary: If services are rendered in India.

- Rental Income: From Indian property.

- Capital Gains: On sale of Indian assets (e.g., property, shares).

- Interest/Dividends: From bank FDs, stocks, or mutual funds.

- Pension: If received in India.

Exemptions: Gifts from relatives, agricultural income (with limits), and certain foreign income remain untaxed.

Pro Tip: NRIs can’t claim most Chapter VI-A deductions (like 80C), but Section 80G donations apply.

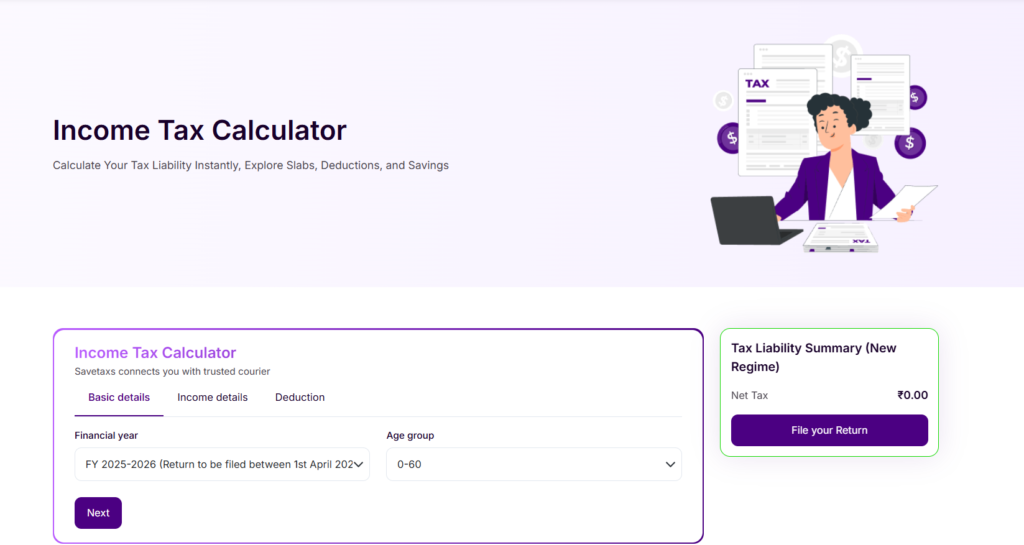

Slabs and Rates: Use an Income Tax Calculator

NRI tax slabs mirror the new (default) regime for FY 2025-26 (AY 2026-27), post-Budget 2025 updates:

| Income Slab (₹) | Tax Rate |

|---|---|

| Up to 3,00,000 | Nil |

| 3,00,001 – 7,00,000 | 5% |

| 7,00,001 – 10,00,000 | 10% |

| 10,00,001 – 12,00,000 | 15% |

| 12,00,001 – 15,00,000 | 20% |

| Above 15,00,000 | 30% |

Add 4% Health & Education Cess. Surcharge applies on high incomes (₹50 lakh+).

Quick Tool: Plug your figures into a free Income Tax Calculator on the e-filing portal (incometax.gov.in) or apps like savetaxs. It factors in TDS, exemptions, and rebates saving you hours!

TDS on NRI Income: Master the TDS Calculator

TDS (Tax Deducted at Source) is the government’s upfront collection mechanism. Rates are higher for NRIs (e.g., 30% + cess on rent, interest; 20-30% on capital gains).

| Income Type | TDS Rate for NRIs |

|---|---|

| Rent (Property) | 30% |

| Interest (FDs) | 30% (if >₹50k) |

| Dividends | 20% |

| Long-term Capital Gains (Equity) | 10% (above ₹1 lakh) |

Essential Tool: Use a TDS Calculator to estimate deductions and claim credits via Form 26AS. Lower TDS with Form 13 (for lower/nil deduction) or Form 15G/H (if eligible).

NRIs get DTAA (Double Taxation Avoidance Agreement) relief claim credits for foreign taxes paid.

How to File Income Tax as an NRI

Step-by-Step to File Income Tax:

- Get PAN and Aadhaar: Mandatory. Link via NSDL/UTIITSL.

- Choose ITR Form: ITR-2/3 for most NRIs (no business income). ITR-1 if only salary/one house.

- Register on e-Filing Portal: Use IFSC + bank details for verification.

- Gather Docs: Form 16/26AS, AIS (Annual Information Statement), bank statements.

- Compute Tax: Use Income Tax Calculator for slabs/TDS.

- E-File by July 31: Pre-validate bank account; verify via Aadhaar OTP or net banking.

- Pay Advance Tax: If liability >₹10,000 (quarterly deadlines).

NRI-Specific: Repatriate refunds only to NRO/NRE accounts. Late filing? Penalty up to ₹5,000 + interest.

Claim Refunds and Optimize Taxes

Overpaid TDS? Track via Form 26AS and file for refunds. Optimize with:

- DTAA benefits (e.g., lower rates with USA/UAE).

- Invest in NRE FDs (tax-free interest).

- Sell assets strategically to minimize LTCG (indexation benefits).

Tools like TDS Calculator and Income Tax Calculator make this effortless.

Common Mistakes NRIs Make

- Ignoring AIS mismatches.

- Missing July 31 deadline.

- Not claiming DTAA relief.

- Using Resident bank accounts for refunds.

Stay updated via incometaxindia.gov.in or apps.

You May Also Like to Read :- NRI Consultancy Service

Final Thoughts: Simplify NRI Income Tax Today

Mastering NRI Income Tax means using smart tools like Income Tax Calculator and TDS Calculator to file Income Tax accurately. Compliance unlocks refunds and growth—don’t let taxes drain your hard-earned money.

![hrz5yalx[3]](https://dailystorypro.com/wp-content/uploads/2026/02/hrz5yalx3-300x225.png)