Non-Resident Indians (NRIs) must file Income Tax returns if they have taxable India-sourced income or TDS deductions, even if tax liability is zero. With deadlines approaching for AY 2026-27 (FY 2025-26), mastering NRI ITR Filing ensures compliance, refunds, and avoids penalties. This guide covers using an Income Tax Calculator, TDS Calculator, handling capital gains, and more.

Determine Your NRI Residential Status

Under the Income Tax Act, you’re an NRI if you’re in India for less than 182 days in the financial year or meet combined stay criteria over four years. NRIs are taxed only on income earned or received in India, like rent, interest, or capital gains from assets.

Use the e-filing portal’s residency calculator to confirm status before file Income Tax.

Taxable Income Heads for NRIs

Key sources include:

- Salary for services rendered in India.

- Rental income from property.

- Capital gains from selling shares, property, or mutual funds.

- Interest from FDs, savings, or dividends.

- Pensions received in India.

NRIs report capital gains separately short-term (STCG) at slab rates, long-term (LTCG) at 12.5% (equity) or 20% with indexation (property). Tools like TDS Calculator help track deductions on these.

ITR Forms for NRI ITR Filing

Choose based on income:

| ITR Form | Suitable For NRIs With |

|---|---|

| ITR-1 | Salary, one house property (no capital gains) |

| ITR-2 | Capital gains, multiple houses, foreign assets |

| ITR-3 | Business/professional income alongside others |

Most NRIs use ITR-2 or ITR-3. Select the new tax regime (default) or old for deductions.

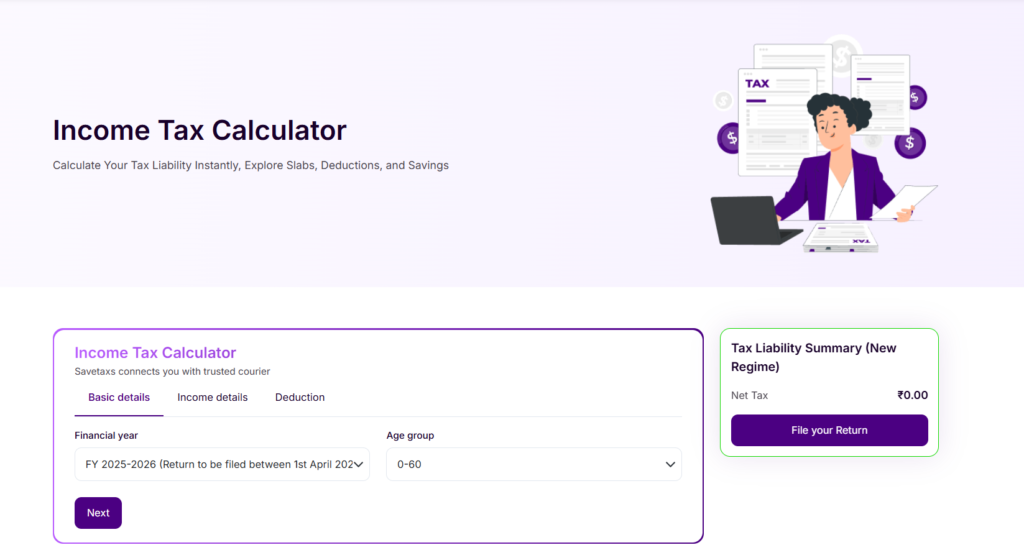

Essential Tools: Income Tax Calculator and TDS Calculator

Estimate liability with an Income Tax Calculator on input slabs, deductions, and capital gains. New regime slabs (₹0-3L: Nil; up to ₹15L+: 30% + 4% cess).

TDS Calculator reveals credits from Form 26AS/AIS: 30% on rent/interest, 20% dividends, 12.5-20% on capital gains. Claim DTAA relief for double taxation.

Documents Needed for NRI ITR Filing

Gather these:

- PAN (mandatory).

- Passport for stay proof.

- Form 16/16A (TDS certificates).

- Form 26AS/AIS.

- Bank statements (NRE/NRO).

- Property/sale deeds for capital gains.

- Foreign asset details (Schedule FA).

Digital copies suffice for e-filing.

Step-by-Step: How to File Income Tax as NRI

- Register/Login: On incometax.gov.in with PAN.

- Select AY 2026-27: Choose “Online” mode, ITR-2/3.

- Enter Details: Personal info, select “Non-Resident,” input income (salary, house property, capital gains).

- Compute Tax: Use Income Tax Calculator integration; apply deductions (80C up to ₹1.5L in old regime).

- Claim TDS: Verify via TDS Calculator against 26AS.

- Pay Taxes: Advance/self-assessment via Challan 280 if owed.

- Preview/Submit: E-verify via Aadhaar OTP/net banking within 30 days.

- Track Refund: To NRE/NRO account.

Deadline: July 31. Late fee: ₹5,000 max.

Handling Capital Gains in ITR

Report capital gains accurately:

- STCG: Under “Schedule CG.”

- LTCG: Index property gains; equity over ₹1.25L at 12.5%.

- Exemptions: Reinvest in 54EC bonds or house (54F).

Mismatch AIS? Update via compliance portal.

Claim Refunds and Avoid Pitfalls

Overpaid TDS? Refunds auto-process post-verification. Common errors: Wrong status, missing capital gains, AIS ignores. Use TDS Calculator for precision.

Opt for old regime if deductions exceed new benefits; NRIs qualify for limited 80C/80D.

Stay Compliant in 2026

NRI ITR Filing is straightforward with file Income Tax tools like Income Tax Calculator and TDS Calculator. Track Budget 2026 updates for capital gains tweaks. Consult a CA for complex cases like crypto or inheritance.

You May also like to Read:- NRI Income Tax: A Complete Guide to File Income Tax and Save on Taxes in 2026