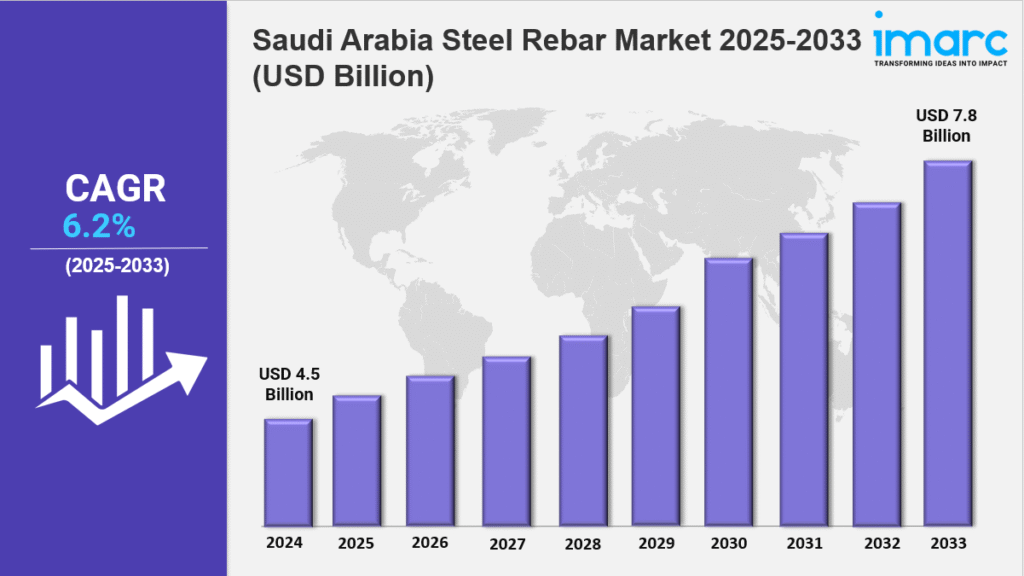

Market Overview 2025-2033

The Saudi Arabia steel rebar market size reached USD 4.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 7.8 Billion by 2033, exhibiting a growth rate (CAGR) of 6.2% during 2025-2033. The market is expanding due to increasing construction activities, rising infrastructure development, and growing demand for durable building materials. Government projects, urbanization, and technological advancements in steel production are key factors driving industry growth.

Key Market Highlights:

✔️ Strong market growth driven by increasing construction and infrastructure development projects

✔️ Rising demand for high-strength and corrosion-resistant steel rebar

✔️ Expanding government investments in megaprojects and urbanization initiatives

Request for a sample copy of the report: https://www.imarcgroup.com/saudi-arabia-steel-rebar-market/requestsample

Saudi Arabia Steel Rebar Market Trends and Drivers:

The Saudi Arabia steel rebar market is gaining significant momentum, driven by the Kingdom’s ambitious Vision 2030 initiative. As Saudi Arabia accelerates its economic diversification and infrastructure expansion, megaprojects like NEOM, the Red Sea Project, and Qiddiya Entertainment City—collectively backed by over $1 trillion—are generating unprecedented demand for steel rebar. Essential to the construction of highways, skyscrapers, and industrial complexes, rebar demand has soared, with NEOM alone accounting for nearly 15% of national consumption in 2024.

A defining trend shaping the Saudi Arabia steel rebar market share is the strategic push for local sourcing and public-private partnerships. Domestic steel producers are experiencing heightened demand as contractors turn to local supply chains to meet aggressive timelines. Simultaneously, international firms are entering joint ventures with Saudi manufacturers to enhance supply chain resilience. However, the market is not without challenges—global steel price volatility and supply chain disruptions continue to test the scalability and cost-efficiency of local production.

Vision 2030’s broader aim to reduce oil dependency has shifted focus toward housing, tourism, and industrial diversification. The planned development of over 555,000 new homes and an expanding tourism sector are key drivers of steel rebar demand. In 2024, the healthcare and hospitality sectors surged, with landmark projects like the Amaala resort and King Salman Energy Park requiring high-strength, specialized rebar. Coastal and industrial regions such as Ras Al-Khair are further spurring demand for corrosion-resistant materials.

Sustainability has emerged as a cornerstone of the market’s evolution, significantly influencing the Saudi Arabia steel rebar market size. With a national commitment to net-zero emissions by 2060, new regulations mandate that at least 20% of materials in public projects be carbon-neutral. This has accelerated investments in green technologies, notably electric arc furnace (EAF) systems that reduce carbon emissions by up to 60% compared to conventional methods. Leading producers like Saudi Iron & Steel Company (HADEED) are already rolling out low-emission rebar under the Saudi Green Initiative.

Adherence to Environmental, Social, and Governance (ESG) standards is now a competitive differentiator. Companies embracing sustainable practices—such as scrap metal recycling and circular production models—are more likely to win public contracts and reduce material costs while boosting their environmental credentials.

According to the latest Saudi Arabia steel rebar market report, the sector is entering a dynamic and complex phase. Urbanization, shifting regulations, and geopolitical influences are reshaping the market landscape. Rebar consumption is expected to grow at an annual rate of 6–8% through 2030. To counteract 2024’s global trade disruptions, the government introduced protective tariffs and subsidies, boosting domestic steel production by 12% and lowering import dependence.

Market segmentation is becoming increasingly specialized. High-performance, corrosion-resistant rebar is now standard in flagship and coastal projects, while conventional grades remain dominant in housing and infrastructure builds. Sustainability has become a baseline requirement, with many public projects demanding certified carbon-neutral materials. Meanwhile, technologies like AI-driven demand forecasting and blockchain supply chain management are being adopted to increase transparency and operational agility.

In summary, the Saudi Arabia steel rebar market is evolving rapidly in response to transformative policies, growing local capabilities, and a firm commitment to sustainability. While global challenges persist, the convergence of innovation, government support, and strategic investment positions the Kingdom as an emerging powerhouse in the global steel rebar industry.

Saudi Arabia Steel Rebar Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Product Type:

- Deformed

- Mild

Breakup by Process:

- Basic Oxygen Steelmaking

- Electric Arc Furnace

Breakup by Finishing Type:

- Epoxy

- Coated

- Black

Breakup by End Use:

- Residential

- Commercial

- Industrial

Breakup by Region:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145