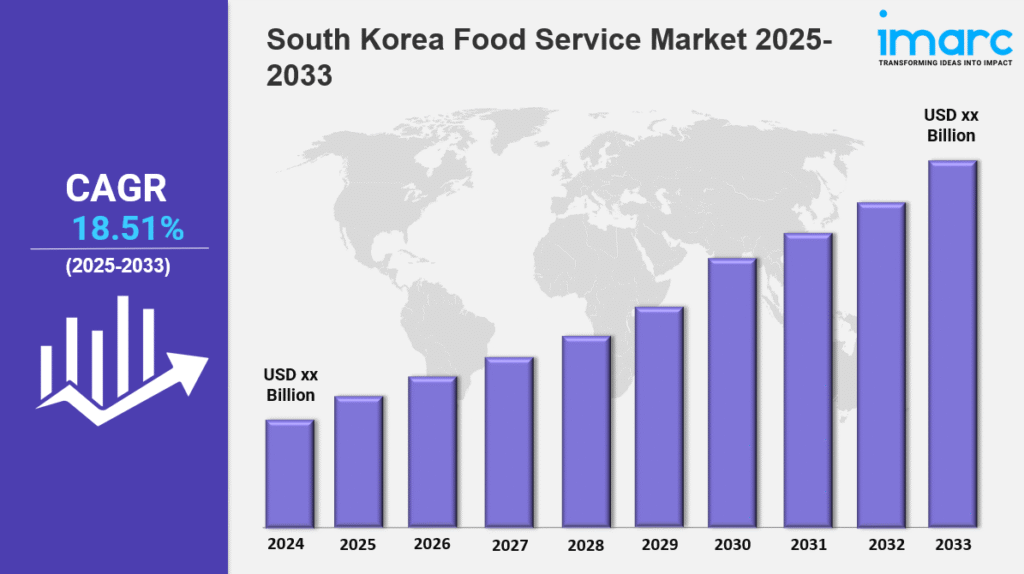

Market Overview 2025-2033

South Korea food service market size is projected to exhibit a growth rate (CAGR) of 18.51% during 2024-2032. The market is growing due to increasing consumer demand for diverse cuisines, rising popularity of online food delivery, and expanding café culture. Technological advancements, urbanization, and evolving dining preferences are key factors driving industry growth.

Key Market Highlights:

✔️ Strong market growth driven by increasing demand for convenience and dining-out culture

✔️ Rising adoption of online food delivery platforms and cloud kitchens

✔️ Expanding preference for international cuisines and premium dining experiences

Request for a sample copy of the report: https://www.imarcgroup.com/south-korea-food-service-market/requestsample

South Korea Food Service Market Trends and Drivers:

The South Korea food service industry is undergoing a rapid transformation, largely driven by digitization and evolving consumer behaviors post-pandemic. With tech-savvy customers at the forefront, restaurants and cafes are increasingly adopting AI-powered ordering systems, robotic kitchen staff, and app-based loyalty platforms to streamline operations and enhance the dining experience. In 2024, delivery-only kitchens—often called “dark kitchens”—experienced significant expansion, particularly as major platforms like Baemin and Coupang Eats continue to scale their virtual restaurant models.

Personalized dining is becoming a key differentiator. Thanks to AI’s ability to analyze vast consumer datasets, customized menus are now common, and innovations like QR code payments and biometric verification are not only widespread in urban areas but are also gaining traction in rural regions. Smart kiosks and experimental drone deliveries are also reshaping access and efficiency in less-populated zones. Despite the progress, high operating costs and cybersecurity vulnerabilities remain significant hurdles, particularly for small businesses. To address this, many are partnering with fintech startups to access more affordable tech solutions.

Health and wellness trends are also reshaping the South Korea food service market size. Consumer demand for organic ingredients, functional foods, and calorie-conscious options is rising sharply. The revised 2024 Food Sanitation Act mandates clearer nutritional transparency, boosting health-centric chains like Saladpapa and Nangam Health Table. Traditional Korean staples such as kimchi and doenjang are being reimagined into premium health foods—featured in probiotic smoothie bowls and low-sodium bibimbap—while the rise of flexitarian diets is leading to hybrid menu designs blending plant-based proteins with traditional meats.

Convenience and health are converging, particularly through the growth of meal-kit subscriptions targeted at busy professionals. These pre-portioned, nutrient-rich kits have seen 40% year-over-year expansion, highlighting a major component of South Korea food service market growth. Meanwhile, influencers on platforms like Instagram and YouTube continue to drive viral interest in local superfoods such as omija berries and Korean ginseng, creating dynamic demand cycles for niche products.

Sustainability is no longer optional in the South Korea food service industry. Consumers and regulators alike are demanding greater transparency in sourcing and waste reduction. Over 1,200 restaurants and cafes in 2024 received “Zero Waste” certification by eliminating single-use plastics and switching to compostable materials. Urban farming is also on the rise—Seoul’s Café Onion, for example, uses rooftop gardens to reduce emissions and reinforce local branding.

Plant-based innovation is another key growth driver. Startups like Armored Fresh are expanding almond-based dairy alternatives, while national chains such as Lotteria have committed to making 30% of their menus fully vegan. Upcycled ingredients—such as bread made from brewery spent grain—are gaining popularity, supported by government-issued carbon credits that incentivize eco-conscious production. Industry giants like CJ CheilJedang are heavily investing in circular economy initiatives, although balancing these innovations with cost-efficiency remains a challenge, especially for SMEs affected by rising organic import tariffs.

The evolving South Korea food service market size reflects two major trends: a split between high-end, personalized dining experiences and scalable, value-driven convenience solutions. Technology plays a pivotal role in both, with AI chatbots enabling custom meal planning and immersive VR dining becoming more common in upscale districts like Gangnam.

In mid-2024, the Ministry of SMEs launched a ₩200 billion initiative to digitize 50,000 traditional eateries by implementing cloud-based POS systems and hygiene standardization protocols. Simultaneously, the global popularity of “K-Food” is boosting international expansion for brands like bibigo and Paris Baguette, leveraging the momentum of the Korean Wave (Hallyu).

Labor shortages, driven by South Korea’s aging population, are further accelerating automation. Humanoid robots are now a regular presence in Lotteria outlets, handling customer service functions. Looking ahead, health tech and culinary innovation are expected to merge. With smart fridges capable of tracking dietary patterns entering homes, and with strong support for sustainability and tech integration, the South Korea food service market growth outlook remains highly positive. Post-2025, the industry will likely focus on achieving inclusive, hyper-personalized growth at scale.

South Korea Food Service Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Foodservice Type:

- Cafes and Bars

- Bars and Pubs

- Cafes

- Juice/Smoothie/Desserts Bars

- Specialist Coffee and Tea Shops

- Cloud Kitchen

- Full Service Restaurants

- Asian

- European

- Latin American

- Middle Eastern

- North American

- Others

- Quick Service Restaurants

- Bakeries

- Burger

- Ice Cream

- Meat-based Cuisines

- Pizza

- Others

Breakup by Outlet:

- Chained Outlets

- Independent Outlets

Breakup by Location:

- Leisure

- Lodging

- Retail

- Standalone

- Travel

Breakup by Region:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145