Market Overview 2025-2033

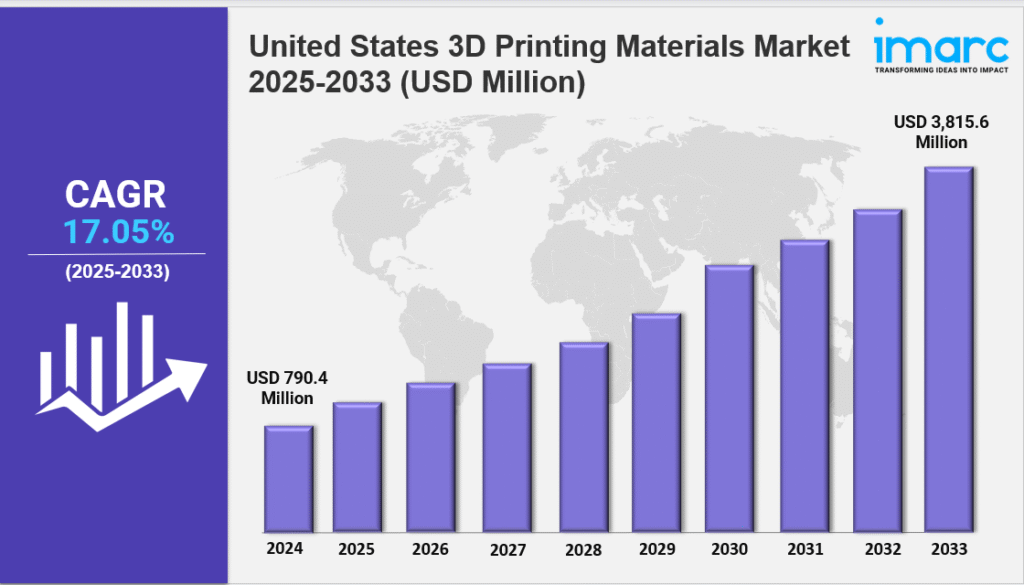

United States 3D printing materials market size reached USD 790.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,815.6 Million by 2033, exhibiting a growth rate (CAGR) of 17.05% during 2025-2033. The market is expanding due to rising demand for diverse, performance‑optimized materials, increased industrial adoption, and growing interest in sustainable biocompatible options. Growth is driven by advancements in high-performance polymers and metals, government support, and broadening application across aerospace, healthcare, and manufacturing.

Key Market Highlights:

✔️ Strong market growth driven by expanding adoption of 3D printing across aerospace, automotive, and healthcare industries

✔️ Rising demand for high-performance materials such as metals, composites, and bioplastics

✔️ Ongoing innovation in sustainable and application-specific materials enhancing printing quality and functionality

Request for a sample copy of the report: https://www.imarcgroup.com/united-states-3d-printing-materials-market/requestsample

United States 3D Printing Materials Market Trends and Drivers:

The United States 3D Printing Materials Market is accelerating rapidly, driven by growing demand from aerospace, defense, healthcare, and advanced manufacturing sectors. Industries are increasingly shifting toward high-performance and sustainable materials, fueling innovation across applications. In 2024, titanium alloys—valued for their strength-to-weight ratio—accounted for 38% of all metal-based 3D printing materials, with major players like GE Additive and SpaceX using them for rocket components and satellite parts. Similarly, nickel-based superalloys such as Inconel 718 are seeing nearly 28% annual growth, particularly for use in military-grade equipment and offshore energy systems.

Federal backing continues to play a pivotal role in United States 3D Printing Materials Market Growth. In 2024, the U.S. Department of Defense allocated over $220 million to scale additive manufacturing for high-impact applications like hypersonic systems and submarine parts. This strategic investment is boosting the United States 3D Printing Materials Market Share globally, positioning the U.S. as a leader in material innovation. However, challenges such as cobalt-chrome shortages have increased costs, prompting companies like Boeing to adopt closed-loop recycling systems to reuse metal powders and reduce import reliance.

Polymers are undergoing significant transformation as well, especially with mounting pressure from sustainability regulations. Bio-based and recycled polymers now comprise roughly 42% of the polymer market in U.S. 3D printing, aided by legislative measures such as California’s SB-54. While PLA still dominates consumer applications, industrial users are shifting to recycled PETG and ABS for more demanding projects. Innovators like Filabot and Reflow are scaling the use of eco-friendly materials, while chemical giants such as DuPont and Covestro experiment with algae-based and self-healing polymers. Despite these advances, strength variability in recycled materials remains a hurdle.

Composite materials are also gaining traction, especially in sectors that demand strength and low weight. Carbon-fiber-reinforced polymers are becoming essential in aerospace, automotive, and medical device production. Carbon-filled nylon led the composite category in 2024, finding applications in BMW brake systems and Lockheed Martin’s satellite structures. Ceramic-infused resins are also reshaping dental labs by reducing prosthetic turnaround times by up to 75%. Government research initiatives, including a $47 million Department of Energy grant to Oak Ridge for smart composite development, are further fueling United States 3D Printing Materials Market Growth. Still, challenges like high carbon fiber prices (~$150/kg) and recyclability limitations are shifting focus to alternatives like basalt-based filaments.

Overall, high-performance metals dominate the United States 3D Printing Materials Market, accounting for over 50% of its estimated $2.3 billion value in 2024. Material selection is increasingly influenced by environmental concerns, with more manufacturers adopting biodegradable or recycled inputs. Domestic production, such as Praxair’s titanium powder plant in Texas, is strengthening local supply chains and reducing foreign dependency—further boosting the United States 3D Printing Materials Market Share.

Growth is not limited to industrial sectors. The educational and hobbyist markets are expanding as well. Roughly 45% of at-home users are opting for engineering-grade materials, while K–12 and university programs favor PLA-based filaments that comply with OSHA’s updated safety guidelines. Meanwhile, emerging technologies like 4D printing—where materials respond to heat, moisture, or pressure—are beginning to find niche applications in biomedical devices and adaptive tools.

Despite strong momentum, the market faces ongoing challenges. Material costs remain volatile, supply chain inconsistencies affect specialty filament availability, and intellectual property issues are rising with the proliferation of replicable, high-value designs. Nevertheless, the future outlook for the United States 3D Printing Materials Market remains highly positive.

By 2030, the market is projected to surpass $4.1 billion, with consistent growth across aerospace, electronics, automotive, and healthcare verticals. Backed by federal investment, improved sustainability practices, and cutting-edge material innovation, the United States 3D Printing Materials Market is well-positioned for continued expansion and leadership on the global stage.

United States 3D Printing Materials Market Segmentation:

The market report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Type:

- Polymers

- Acrylonitrile Butadiene Styrene (ABS)

- Polylactic Acid (PLA)

- Photopolymers

- Nylon

- Others

- Metals

- Steel

- Titanium

- Aluminum

- Others

- Ceramic

- Silica Sand

- Glass

- Gypsum

- Others

- Others

Breakup by Form:

- Powder

- Filament

- Liquid

Breakup by End User:

- Consumer Products

- Aerospace and Defense

- Automotive

- Healthcare

- Education and Research

- Others

Breakup by Region:

- Northeast

- Midwest

- South

- West

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145