IMARC Group has recently released a new research study titled “US Cement Market Size, Share, Trends and Forecast by Type, End-Use, and Region, 2025-2033,” which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

U.S. Cement Market Overview

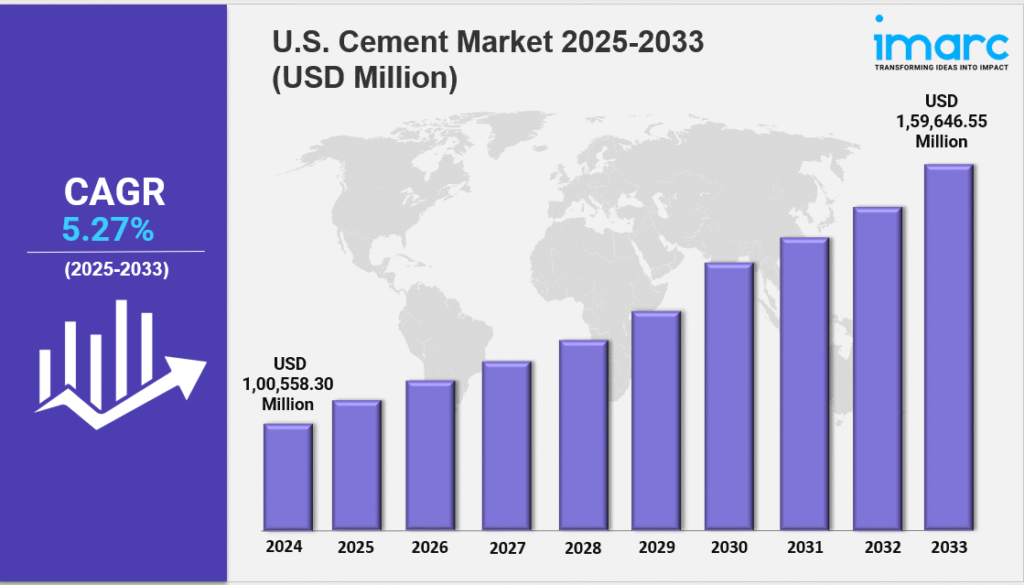

The US cement market size reached USD 1,00,558.30 Million in 2024. The market is projected to reach USD 1,59,646.55 Million by 2033, exhibiting a growth rate (CAGR) of 5.27% during 2025-2033.

Market Size and Growth

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 1,00,558.30 Million

Market Forecast in 2033: USD 1,59,646.55 Million

Market Growth Rate 2025-2033: 5.27%

Request for a sample copy of the report: https://www.imarcgroup.com/us-cement-market/requestsample

Key Market Highlights:

✔️ Strong market growth driven by infrastructure development and residential construction projects

✔️ Increasing demand for blended and low-carbon cement to support sustainability goals

✔️ Expanding investments in automation, energy efficiency, and alternative fuel usage across cement manufacturing plants

U.S. Cement Market Trends

The United States cement market is experiencing robust growth, largely fueled by the federal government’s $1.2 trillion Infrastructure Investment and Jobs Act, which has triggered a sharp rise in public construction projects, including roads, bridges, ports, and airports. This surge in infrastructure spending is expected to continue driving demand through at least 2028, with highway projects alone estimated to require over 32 million metric tons of cement. As a result, cement producers are operating near full capacity, especially in high-demand states like Texas and California, where limestone shortages and logistical issues are putting additional strain on the industry. Challenges such as a lack of truck drivers, delayed deliveries, and rising freight costs—up nearly 23% in recent years—have worsened supply chain bottlenecks.

Regional disparities have emerged, particularly in the Sun Belt, where shortages are more severe, leading to price hikes exceeding 35% in some areas. In response, cement companies are investing more than $4.3 billion in plant upgrades and expansions to meet current and future demand. The industry is also seeing a wave of consolidation, as large players like Holcim acquire smaller regional firms to enhance supply chain efficiency and expand into high-growth markets. Alongside these structural shifts, sustainability has become a top priority. The EPA’s revised Clean Air Act now requires a 40% reduction in cement industry carbon emissions by 2030, pushing manufacturers to adopt greener technologies such as waste-heat recovery systems, carbon capture initiatives, and alternative binders made from recycled materials or volcanic ash.

These efforts have helped create a fast-growing green cement segment valued at $2.1 billion and expanding at an 18% annual rate. However, green cement still faces cost barriers—it is 25% to 40% more expensive than conventional products and accounts for just 7% of shipments as of 2024. Still, eco-certified producers are gaining favor in public infrastructure bids and sustainability-focused projects. While infrastructure spending provides a stable foundation for market growth, residential construction remains unpredictable. In Q3 2024, single-family housing starts fell by 28% due to high interest rates and broader economic uncertainty. In contrast, multi-family housing rose by 19%, especially in urban centers dealing with housing shortages. This uneven trend complicates demand forecasting and distribution planning for cement suppliers.

Material innovation is also reshaping the competitive landscape. Alternatives like mass timber have gained a foothold, accounting for 12% of mid-rise construction and reducing reliance on cement. Meanwhile, 3D-printed buildings that use significantly less concrete are becoming more popular. To maintain relevance, cement producers are developing value-added products such as self-healing concrete for premium housing and fast-setting mixes for modular construction. Technology and automation are further transforming the industry, with more companies adopting AI-driven systems, robotic loading equipment, and smart chemical formulations to increase efficiency and lower emissions. Tools like CarbonCure, now used in 15% of U.S. plants, help track emissions and support premium pricing for low-carbon cement.

Looking ahead to 2025–2033, the U.S. cement market is forecast to grow steadily, led by sustained infrastructure funding, digital transformation, and growing demand for environmentally friendly building materials. Regions like the Southeast and Mountain West are expected to capture 60% of new investment due to rapid urbanization and population growth. However, the sector still faces key challenges, including long permitting processes, labor shortages, and inconsistent state-level regulations for green cement. Despite these obstacles, companies that embrace sustainability, automation, and strategic expansion are well-positioned to capitalize on long-term opportunities in the evolving U.S. cement industry.

Ask Analyst & Browse full report with TOC & List of Figures: https://www.imarcgroup.com/request?type=report&id=37422&flag=C

U.S. Cement Market Segmentation:

The market report segments the market based on product type, distribution channel, and region:

Breakup by Type:

- Blended

- Portland

- Others

Breakup by End-Use:

- Residential

- Commercial

- Infrastructure

Breakup by Region:

- Northeast

- Midwest

- South

- West

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Key Highlights of the Report

- Market Performance (2019-2024)

2. Market Outlook (2025-2033)

3. COVID-19 Impact on the Market

4. Porter’s Five Forces Analysis

5. Strategic Recommendations

6. Historical, Current and Future Market Trends

7. Market Drivers and Success Factors

8. SWOT Analysis

9. Structure of the Market

10. Value Chain Analysis

11. Comprehensive Mapping of the Competitive Landscape

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145