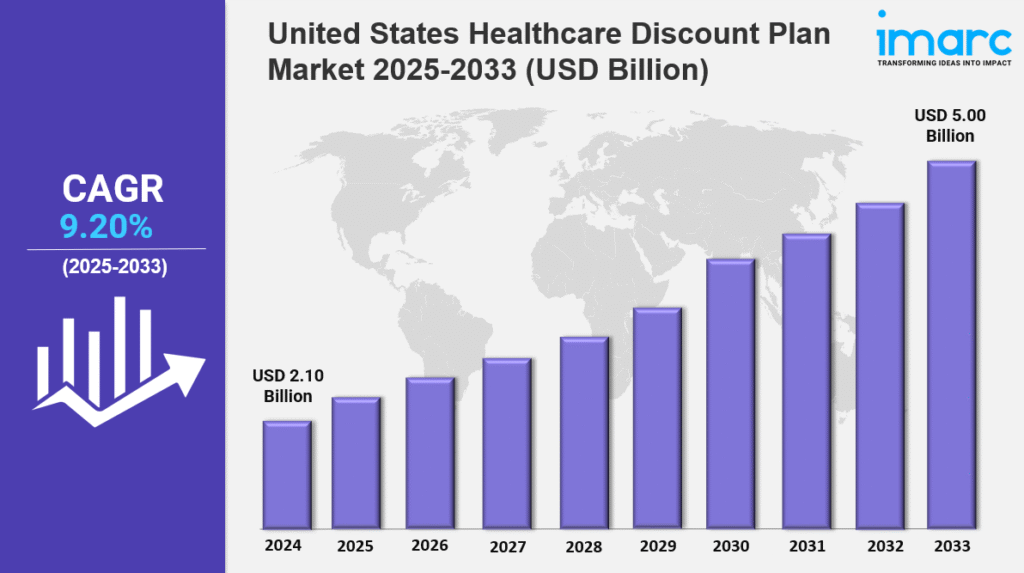

Market Overview 2025-2033

The United States healthcare discount plan market size reached USD 2.10 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.00 Billion by 2033, exhibiting a growth rate (CAGR) of 9.20% during 2025-2033. The market is expanding due to rising healthcare costs, increasing demand for affordable medical services, and growing consumer awareness. Digital platforms, employer-sponsored plans, and regulatory support are key factors driving industry growth.

Key Market Highlights:

✔️ Strong market growth driven by rising healthcare costs and demand for affordable medical services

✔️ Increasing adoption of subscription-based discount plans for dental, vision, and prescription services

✔️ Expanding partnerships between healthcare providers and discount plan networks

Request for a sample copy of the report: https://www.imarcgroup.com/united-states-healthcare-discount-plan-market/requestsample

United States Healthcare Discount Plan Market Trends and Drivers:

The United States healthcare discount plan market is steadily expanding as rising medical costs and gaps in traditional insurance coverage push more individuals to seek affordable alternatives. With premiums, deductibles, and copayments reaching record highs, discount health plans are becoming increasingly attractive to middle-income families, gig economy workers, and the uninsured. A 2024 report from the Kaiser Family Foundation found that nearly 43% of adults under 65 struggled to pay medical bills, highlighting the growing importance of discount plans in the broader healthcare landscape.

These plans offer reduced rates on essential services such as dental care, vision checkups, prescription drugs, and telehealth consultations. In 2024, leading providers like GoodRx and Careington International reported a 22% increase in membership, indicating a rise in consumer demand. As a result, the discount plan market is expanding its reach, especially among groups underserved by conventional insurance. Large insurers like Aetna and Cigna have started incorporating discount networks into high-deductible plans, signaling a shift toward more flexible, hybrid coverage models.

This integration marks a turning point for the industry, as discount plans become a regular feature of employee benefits and individual health strategies. Telehealth is now a common offering in many plans, and over 50% of discount programs include virtual care options, according to a 2024 McKinsey survey. These services meet growing consumer expectations for convenient and affordable care. However, the expansion of digital services brings new concerns. The Department of Health and Human Services reported a 31% rise in data breaches involving discount plan platforms in the second quarter of 2024, underscoring the need for improved cybersecurity measures.

Regulatory oversight is also tightening. In response to recent Federal Trade Commission actions on deceptive marketing, 28 states have passed laws requiring greater transparency in pricing and treatment outcomes. At the national level, the National Association of Insurance Commissioners is working on a standardized accreditation system to help consumers identify reliable discount plan providers.

On the financial side, adoption is gaining momentum due to supportive policy changes. The IRS’s 2024 decision to allow discount plan fees to qualify as Health Savings Account (HSA) expenditures has made these plans more appealing for those seeking tax-efficient healthcare options. Employers are also embracing this model. A JAMA study showed that 41% of mid-sized companies now offer discount plans as voluntary benefits, and 29% of Affordable Care Act marketplace users rely on them to supplement limited insurance coverage.

State-level growth is strongest in Texas and Florida, which together account for 37% of national expansion. These states have large uninsured populations and aging residents, two factors contributing to heightened demand for lower-cost care alternatives. Looking forward, the outlook for the U.S. healthcare discount plan market remains positive. Collaborations with major retailers such as CVS and financial firms providing HSA-linked tools are expected to drive the next phase of growth. As healthcare costs continue to rise, discount plans offer a practical solution for millions of Americans seeking more affordable and accessible care.

United States Healthcare Discount Plan Market Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest United States healthcare discount plan market growth. It includes forecasts for the period 2025-2033 and historical data from 2019-2024 for the following segments.

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Service:

- Health Advocate

- Virtual Visits

- Alternative Medicines

- Prescription Drugs

- Dental Care

- Vision Care

- Hearing Aids

- Chiropractic Care

- Nurse Services

- Vitamins and Supplements

- Wellness Plans

- Podiatry Plans

- Others

Breakup by Region:

- Northeast

- Midwest

- South

- West

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145