In 2025, the world of financial transactions has become more digital and interconnected than ever before. One tool that has gained considerable traction is the use of virtual numbers. Whether it’s for securing online accounts, verifying identities, or performing financial operations, virtual numbers are becoming essential. With an increase in their adoption, it’s only natural to question how secure these virtual mobile numbers are for financial transactions.

As a growing trend, businesses and individuals alike are turning to virtual mobile number provider to safeguard sensitive data, but what does this mean for security? This article dives into the safety aspects of virtual numbers, offering insights into how these numbers help protect financial transactions and what risks may still remain.

What Are Virtual Numbers?

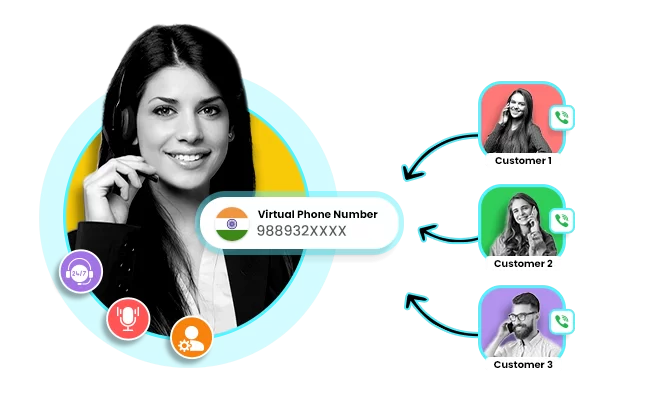

Before understanding the security concerns, let’s define what virtual numbers are. A virtual phone number is a number that is not directly tied to a specific phone line or device. It’s a number that forwards calls, messages, and other communications to another phone number, usually through cloud-based platforms.

Virtual numbers are increasingly popular for a range of uses: businesses use them for customer service lines, individuals rely on them for privacy when signing up for services, and financial institutions use them to ensure secure transactions.

The Security of Virtual Numbers in Financial Transactions

How Virtual Numbers Enhance Security

Virtual numbers can be a boon for securing financial transactions. These numbers act as an additional layer of protection by separating your real phone number from the transaction process. For example, when you perform a transaction, the financial institution may send a one-time password (OTP) or verification code to your virtual number. This ensures that even if your real phone number is compromised, the attacker will not have access to the verification codes sent for sensitive operations.

Additionally, virtual numbers provide privacy and reduce the risk of identity theft. By masking your personal number, hackers are less likely to gather information that could be used to steal your identity or access your financial accounts.

Two-Factor Authentication and Virtual Numbers

A major benefit of virtual numbers is their compatibility with two-factor authentication (2FA). 2FA is a security process where the user provides two forms of identification before accessing an account—typically a password and a code sent to their phone. Virtual numbers are frequently used for this purpose.

For financial transactions, banks and payment systems now rely heavily on 2FA for protecting users from unauthorized access. With a virtual mobile number provider, individuals can ensure that their transactions remain secure even if their primary phone number is compromised or lost.

Isolation from Primary Numbers

Using a virtual number also creates isolation between financial operations and your main personal communication channel. This reduces the chances of exposing sensitive transaction details. The concept is simple: the fewer touchpoints your financial details have with your primary contact information, the less risk of unauthorized access.

Risks Associated with Virtual Numbers

While virtual numbers provide a degree of security, there are still some risks that users should be aware of.

Vulnerability to SIM Swapping Attacks

A significant risk is SIM swapping, where an attacker tricks a mobile carrier into switching your phone number to a new SIM card that they control. While virtual numbers themselves cannot be swapped in the same way, if the virtual number is linked to a physical SIM card, the attacker may still exploit it. This means that your security could be compromised if your virtual number is not fully isolated from your main phone line.

Reliance on the Virtual Mobile Number Provider

Your security is only as good as the provider you choose. If the virtual mobile number provider’s platform is compromised, your number and related transaction details could be at risk. This highlights the importance of selecting a reputable virtual mobile number provider with robust encryption and security measures.

Best Practices for Securing Virtual Numbers in Financial Transactions

If you’re considering using virtual numbers for your financial transactions, there are several steps you can take to further ensure your security:

1. Choose a Reputable Virtual Mobile Number Provider

Not all virtual mobile number providers are created equal. Some may offer minimal security features, while others provide advanced encryption and fraud protection. Always choose a provider with a track record of maintaining high security standards, especially one that offers additional layers of verification and encryption for transactions.

2. Use Dedicated Virtual Numbers for Financial Transactions

To further isolate your financial activities, use a dedicated virtual number solely for your banking and financial transactions. This will prevent cross-contamination with personal communication and provide an additional layer of security.

3. Enable Multi-Factor Authentication

Whenever possible, enable multi-factor authentication (MFA) for all accounts linked to your virtual number. This can significantly reduce the risk of unauthorized access, even if your virtual number is compromised.

4. Regularly Monitor Account Activity

Regularly checking your financial accounts and transaction histories can help you detect suspicious activity early. Many financial institutions offer real-time notifications for account changes, so make sure these are activated to stay informed.

5. Use Strong Passwords

A strong password combined with a virtual number and multi-factor authentication offers a layered security approach. Always choose complex, unique passwords for your accounts and avoid using the same password across multiple platforms.

Conclusion: A Secure Future for Virtual Numbers?

In 2025, virtual numbers offer a secure, reliable solution for protecting financial transactions. While no security measure is completely foolproof, the added layer of privacy and protection they offer makes them a valuable tool in the digital age. By understanding their advantages and risks, and following best practices, users can ensure that their virtual numbers remain secure, minimizing the chances of financial fraud and identity theft.

Ultimately, the security of virtual numbers for financial transactions in 2025 depends on choosing the right provider, staying vigilant, and employing comprehensive security practices. With the right approach, virtual numbers can be a strong ally in the protection of sensitive financial data.

SpaceEdge Technology: Digital Marketing Service Provider

SpaceEdge Technology is a leading digital marketing company in India, offering comprehensive services since 2008. They specialize in SEO, social media marketing, PPC, UI/UX design, and more. With over 20 years of experience, their data-driven strategies aim to enhance online visibility and drive business growth. Recognized as the best digital marketing company in India, they provide tailored solutions to meet diverse client needs.