CGAA won’t be liable for any losses and/or damages incurred with using the data provided. Study tips on how to decide its classification for correct monetary reporting. Teresa Halvorson is a talented author with a passion for monetary journalism. Her expertise lies in breaking down advanced matters into partaking, easy-to-understand content material. With a eager eye for element, Teresa has successfully coated a spread of article categories, together with foreign money trade rates and foreign trade rates.

If you promote property and buy similar property in two mutually dependent transactions, you may have to treat the sale and buy as a single nontaxable change. The trade of real property could qualify as a nontaxable trade underneath part 1031 of the Inner Revenue Code. Your employer offers you inventory for services carried out underneath the condition that you will have to return the stock unless you complete 5 years of service.

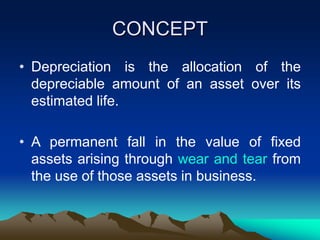

Depreciation is recorded in the company’s accounting records through adjusting entries. Adjusting entries are recorded within the general journal using the final day of the accounting period. The distinction between the debit steadiness in the asset account Truck and credit steadiness in Accumulated Depreciation – Truck is named the truck’s book value or carrying value. At the top of three years the truck’s e-book value might be $40,000 ($70,000 minus $30,000). Earnings statement accounts are known as momentary accounts since their account balances are closed to a stockholders’ fairness account after the annual earnings statement is ready. To illustrate the value of an asset, assume that an organization Depreciable asset definition paid $10,000 to buy used tools positioned 200 miles away.

The Depreciable Foundation is the total worth of a fixed https://www.quickbooks-payroll.org/ asset (PP&E) that a company can depreciate over its useful life assumption. Mounted property are handled as property within the firm’s steadiness sheet. The company owns fastened assets, which they’ll utilize as needed till they’re disposed of.

If you purchase a quantity of property for a lump sum, you and the vendor may conform to a particular allocation of the purchase value among the many assets in the sales contract. If this allocation is based on the value of every asset and also you and the seller have adverse tax interests, the allocation will generally be accepted. For tax years starting after 2024, see the instructions for your applicable revenue tax return for the common annual gross receipts test threshold amount for the present tax year. The common annual gross receipts check threshold quantity can be out there at IRS.gov/Newsroom/Inflation-Adjusted-Tax-Items-by-Tax-Year.

- At the time of the transfer, the transferor must provide the information essential to determine the adjusted foundation and holding period of the property as of the date of switch.

- If the revenues earned are a main activity of the business, they’re thought of to be working revenues.

- Property turns into considerably vested when your rights within the property or the rights of any person to whom you transfer the property aren’t topic to a substantial risk of forfeiture.

Example Of A Loss On Sale Of An Asset

It may be one thing that helps lower expenses, corresponding to specialised equipment that makes workers extra environment friendly and efficient at their jobs. Money would even be considered an asset since it may be used to pay staff or to buy other belongings wanted to take care of operations. You might have private belongings, like your house, a financial savings account, a life insurance policy, or a particular set of skills.

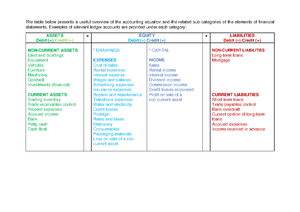

The accounting term that means an entry will be made on the left aspect of an account. If the revenues earned are a major exercise of the enterprise, they’re thought of to be working revenues. If the revenues come from a secondary activity, they’re considered to be nonoperating revenues. For instance, interest earned by a producer on its investments is a nonoperating revenue. Interest earned by a bank is taken into account to be a half of working revenues. The “sum-of-the-years’-digits” refers to including the digits in the years of an asset’s helpful life.

Depreciable Assets

The return on assets is the ratio between internet revenue and average total property. It Is very comparable to the turnover ratio however appears at an organization’s bottom-line income as an alternative of its top-line gross sales development. It’s far more useful for mature companies than for small growth stocks. An asset could be one thing that helps enhance revenue, similar to inventory.

Accounting Fundamentals: “depreciable Asset” Fundamentals Quiz

If you make this choice, the substantially vested guidelines don’t apply. Your foundation is the amount you paid plus the quantity you included in earnings. You received inventory from your employer for companies you carried out. If you wish to sell the stock when you’re nonetheless employed, you have to sell the stock to your employer at book worth. At your retirement or demise, you or your property should offer to sell the inventory to your employer at its book worth. This is a restriction that by its phrases will never finish and you have to think about it when you determine the FMV.

A depreciable asset is property that gives an economic benefit for a couple of reporting period. As long as this asset exceeds a firm’s capitalization restrict, it is recorded as a set asset within the organization’s accounting data. It is then depreciated over its helpful life, which steadily reduces its guide worth over the interval when it’s presumed to be providing an economic benefit to the enterprise.

As a end result this stuff usually are not reported among the assets showing on the stability sheet. Things which would possibly be assets owned by an organization and which have future economic worth that could be measured and could be expressed in dollars. Examples embody money, investments, accounts receivable, stock, supplies, land, buildings, tools, and autos. Since depreciation isn’t intended to report a depreciable asset’s market worth, it is potential that the asset’s market worth is significantly lower than the asset’s e-book worth or carrying quantity.